What Is a College Grant?

Maintaining a balanced life while studying, especially with the costs of tuition, boarding, and books, can be quite challenging. This is where college grants became essential in financing my education. Grants provided me with much-needed financial relief, not just for tuition and academic-related expenses during college but also afterward, since they do not require repayment like student loans.

Even if you're hearing about college grants for the first time, they are critical for budgeting your education. In this blog, I will explore the basics of college grants, their importance, eligibility criteria, the application process, and how to manage them effectively.

Grants not enough to pay for college? Create an account and gain access to hundreds of scholarships today on Bold.org - all committed to helping you graduate school debt-free!

Source: https://studentaid.gov

Understanding College Grants and Federal Student Aid

What is a college grant, you ask? A college grant is a type of financial aid that does not require repayment; a college grant is a form of financial aid that does not require repayment. The most common grants are offered by federal and state government grants, such as the Pell Grant.

Similar to scholarships, grants provide a unique opportunity for millions of individuals who would not be able to pay for college. Their goal is to bridge the financial gap and ensure that talented students can access the educational opportunities they deserve, regardless of their economic background.

Financial Aid: Different Types of College Grants

Federal Grants

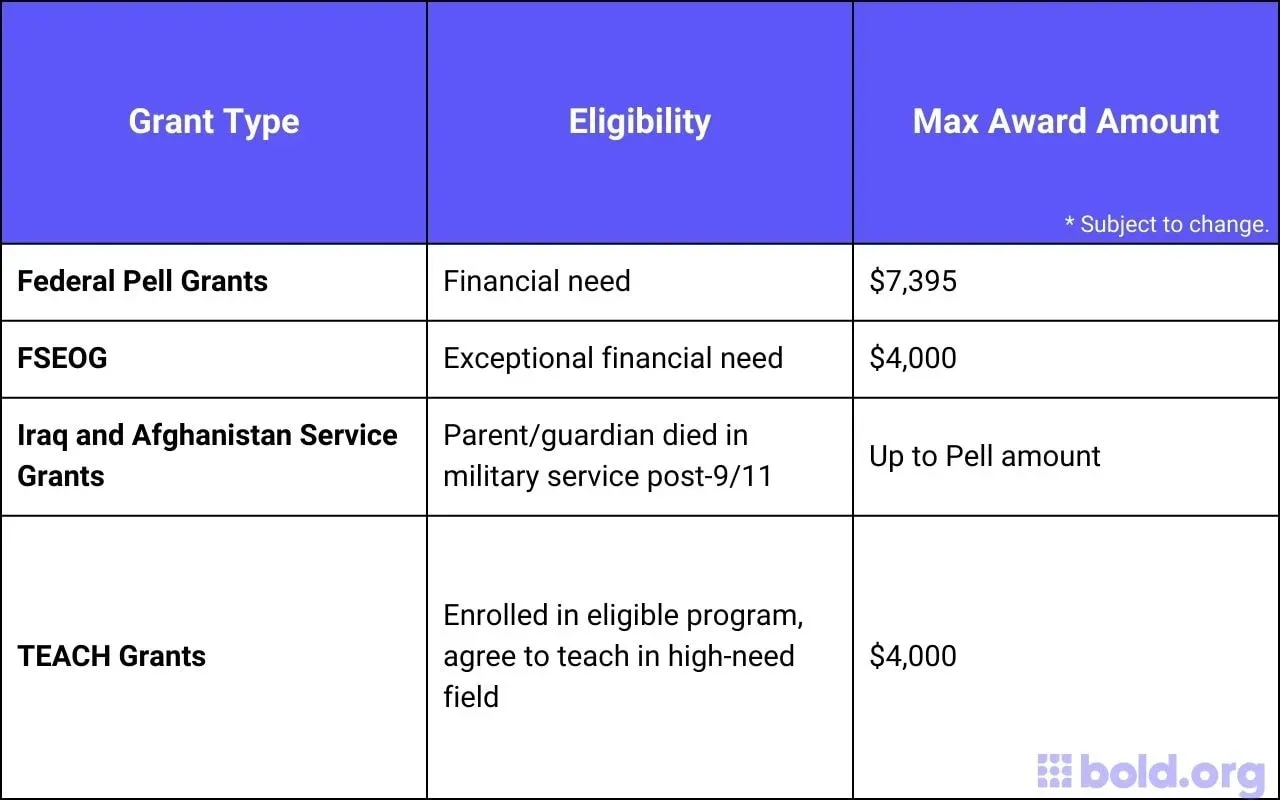

These need-based grants are awarded according to the financial circumstances of the student and their family. Students are required to complete the Free Application for Federal Student Aid (FAFSA) to qualify for these grants and determine how much they will receive for the year.

The FAFSA Form allows the federal government to assess financial needs and allocate grants accordingly. One of the most significant grants you'll encounter is the Pell Grant, which offers substantial support to undergraduate students with exceptional financial need and provides a reassuring safety net.

Like most grants tailored to help you with school, they are not paid directly to students but are instead awarded to their school. The financial aid office of the participating school then applies these funds to cover tuition and fees and, if any funds remain, refunds the balance to the student for other educational expenses such as books and living costs. This direct-to-school approach ensures that the grant funds are used primarily for educational purposes.

Get Matched to Thousands of Scholarships

Create your Bold.org profile to access thousands of exclusive scholarships, available only on Bold.org.

Create Free ProfileState Grants

Like federal grants, state grants are provided by individual state governments to support residents pursuing higher education. Unless articulated otherwise, these opportunities are need-based, though some states also offer merit-based grants or grants targeted at specific fields of study or demographics. State grants were created to make college particularly more affordable for in-state students.

Some state and federal grants are tied to military organizations like ROTC and the National Guard. Students are eligible to join either training program in college and will likely receive stipends or grants to make their tuition more affordable.

If that sounds like a good fit for you, apply for National Guard scholarships today!

Institutional Grants

Institutional grants are provided directly by colleges and universities to help students attend college. Each institution has its own unique criteria and processes for awarding these grants, which can be based on financial need, academic merit, or specific talents and interests. This variety ensures that there are multiple paths to financial support, catering to a diverse range of students.

Career-Specific Oriented Grants

Depending on your career field, you can always find free money by looking at scholarship platforms tailored to each student's specific grants and scholarships. For example, Bold.org is a nonprofit platform that provides resources to help students pay for school and find resources.

With thousands of scholarships available, students can apply while also receiving other grant programs. By committing a couple of hours a week to applications, you're not just applying for these opportunities but also making a smart investment in your future. This consistent effort will surely pay off, bringing you closer to your educational goals and a brighter future.

Financial Benefits of College Grants

Grants can also significantly alleviate the burden of student loan debt. Unlike student loans, grants do not accrue interest or require repayment, providing students with a free, debt-free start to their careers. This financial freedom allows graduates to pursue their professional goals without the shackles of student loans and repayments hindering their progress.

According to a study conducted by the National Center for Education Statistics, students receiving grants have a higher likelihood of completing their degrees compared to those who lack financial or education assistance for college themselves. This data underscores the significant role grants play in reducing financial barriers and improving educational outcomes. It should serve as a strong motivation for you to pursue your degree, even if you think you can't afford it.

Impact on Educational Opportunities

Grants also alleviate the financial burden by providing students with the freedom to pursue research projects, internships, or study abroad opportunities that may initially seem out of reach. These opportunities broaden horizons, expose students to different cultures, and foster a deeper understanding of their field of study.

Eligibility Criteria: School's Financial Aid Office

Academic Requirements

The eligibility criteria for college grants vary. Some grants consider academic performance to be the most crucial factor. This can include maintaining a minimum GPA, meeting specific course requirements, or excelling in standardized tests such as the SAT or ACT.

While some emphasize academic achievement, others take a different approach, considering factors like community involvement, leadership experience, or unique talents. So, don't be discouraged from applying to grants because of your GPA. It's essential to thoroughly review the eligibility requirements of all the potentially available grants to find one that works for you.

Furthermore, academic requirements may also extend to the choice of major or field of study. Some grants are specifically tailored to students pursuing specific disciplines, such as STEM (Science, Technology, Engineering, and Mathematics) fields, or those focusing on social impact and community service.

Understanding these specialized criteria can help you narrow your search for relevant grants and increase your chances of securing financial assistance for your education.

Financial Need Assessment

As discussed for federal and state need-based grants, demonstrating financial need is primarily used to delegate grants. By providing need-based grants, there are greater chances for low-income households to grow.

Financial need for federal aid is typically determined by evaluating your family's income, assets, and expenses. Granting organizations often use a standardized formula, such as the Free Application for Federal Student Aid (FAFSA), to assess a student's financial need.

Some grants may consider special circumstances that impact your financial situation in addition to traditional financial metrics. These can include expenses such as caregiving responsibilities, medical expenses, or other unique challenges. A comprehensive overview of your financial landscape can help grant providers understand your needs and make a more informed decision when awarding grants.

How to Apply for College Grants

The first step in applying for grants is to fill out your FAFSA form. Additionally, online resources such as grant databases, scholarship websites, and educational institution financial aid offices can provide valuable information about available grants. Consider factors such as eligibility criteria, application deadlines, and the documentation required for each grant.

Understanding Grant Terms and Conditions

Understanding Grant Terms and Conditions It's crucial to align your own goals and aspirations with those of the grant provider. This can create a more meaningful connection and potentially open doors to additional opportunities. Familiarize yourself with the obligations, such as maintaining a certain GPA or completing a set number of credit hours each semester to remain eligible for renewal. Research the organizations or individuals who have funded your grant and learn about their mission and values.

Renewal and Continuation of College Grants

According to your program, grants can be renewable for many years, provided that you meet the specified criteria and submit the necessary documentation on time. To eliminate disruptions, you should ensure that you continue to meet the grant's requirements throughout your college journey. Regularly communicating with the grant provider and the financial aid office can help you stay on top of any changes or updates to the renewal process.

Frequently Asked Questions About College Grants

How does family income affect my eligibility for federal student aid grants for college?

Family income significantly affects your eligibility for most federal student loans and aid grants for college. When you complete the FAFSA, your Expected Family Contribution (EFC) is calculated based on your family income, assets, and other factors. High school students from low-income families typically have a lower EFC, which can make them eligible for more federal student aid, such as the Pell Grant and Federal Supplemental Educational Opportunity Grants (FSEOG).

What are Iraq and Afghanistan Service Grants?

Iraq and Afghanistan Service Grants are federal student aid grants for college students whose parents or guardians died as a result of military service in Iraq or Afghanistan after 9/11. These grants are typically awarded to students who are not eligible for Pell Grants due to their family income but meet other financial need criteria. These grants provide financial assistance for tuition, fees, and living expenses.

What is the Teacher Education Assistance for College and Higher Education (TEACH) Grant, and who is eligible for it?

The Teacher Education Assistance for College and Higher Education (TEACH) Grant is a federal student aid grant for college students who intend to teach in a high-need field at a low-income school. To qualify, you must enroll in a TEACH Grant-eligible program and agree to teach for at least four years within eight years of completing your program. This grant helps students who are preparing for careers in education and aims to address the demand for qualified teachers in underserved areas.

Curious to learn more? Follow Bold.org's blog page to find out how you can save money at college and beyond.