Does Duke Allow Scholarship Stacking: Your Guide to Maximizing Financial Aid

Duke University is a prestigious private research institution located in Durham, North Carolina, known for being one of the nation's top universities. Their academic approach is known for being rigorous and highly demanding. As someone who has attended an Ivy League university, I find the rigor of getting into the school just as challenging as the program itself. While Duke University has produced cutting-edge research in many fields, from physics to medicine, it is easy to lose sight of the end goal once the tuition bill comes in. But don't let this deter you from attending the school. I have everything you need to know about Duke University and what they accept in terms of scholarships and financial aid.

In this article, I will introduce you to the world of Duke University's finances and how financial aid works. My goal is to prepare you for what comes after your acceptance so you are better equipped and able to navigate your life as a student, as well as give you clarity on the question: "Does Duke allow scholarship stacking?" Let's get started.

Interested in a world-class education at Duke University? Bold.org is your key to unlocking the hidden doors of scholarship opportunities for your college journey!

Get Matched to Thousands of Scholarships

Create your Bold.org profile to access thousands of exclusive scholarships, available only on Bold.org.

Create Free ProfileWhat is Scholarship Stacking?

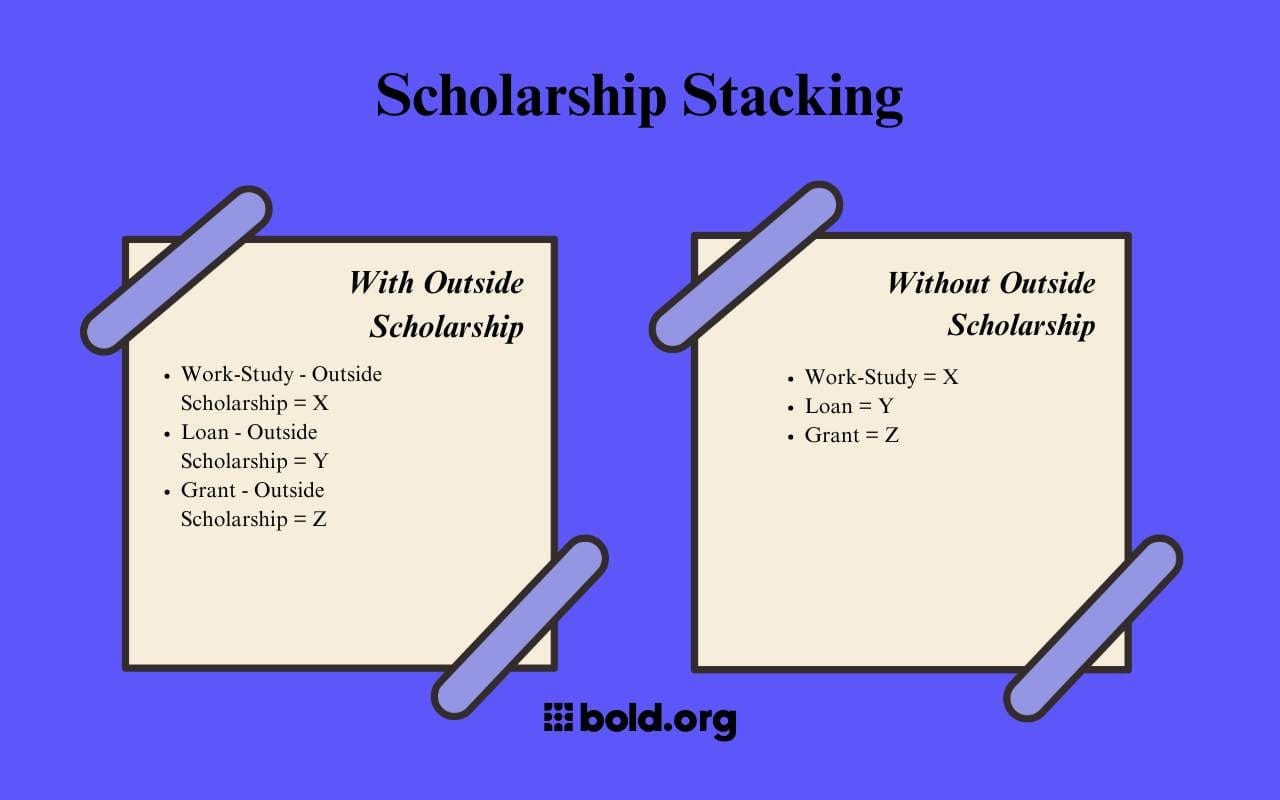

For any future Duke student, it's important to understand scholarship stacking and whether Duke University allows students to do so. Scholarship stacking refers to allowing students to combine multiple scholarships at the same time. Consequently, students are able to accumulate financial aid from various sources, such as merit scholarships, need-based scholarships, outside scholarships, and others.

Duke's Approach to Financial Aid

Duke is a university that gives students financial aid according to their financial circumstances. Just over half of Duke students pay less than the total cost of attendance, and about one-fifth of first-year students receive tuition free. The University's website offers a calculator for you to estimate the tuition you will have to pay to attend the University.

It is important to understand that Duke University will analyze how much a student will pay using the expected family contribution (EFC), which is collected with the FAFSA form. However, it may change for the next school year with the student aid index (SAI), which is substituting for the EFC. After calculating the EFC, the University will calculate the aid offered to students to be the cost of attendance minus expected family contribution.

Duke's Scholarship Stacking

After reviewing each student's aid offered, students are ready to know how much more financial aid would be ideal for them to cover educational expenses. It is essential to understand that Duke offers various ways to help students pay their tuition, such as institutional grants, merit aid, loans, and work-study.

Duke's policy regarding outside scholarships is that they allow scholarship stacking. However, Duke will first use the scholarship to cover the financial aid that was given to the students, such as grants, merit aid, or loans.

Create Your Free Profile to Apply for Scholarships Today!Below are some examples based on data from Duke's website I believe will give you a clearer understanding of scholarship stacking:

Example 1

Alex is a first year and has received generous financial aid from Duke. Alex did not apply for any outside scholarship. Here is the breakdown of his financial aid package:

- Work study: $2,200

- Student loans: $5,000

- Duke grant: $30,000

- Total Aid: $37,200

Example 2

Anna is a sophomore student and received the same financial aid package as Alex. However, Anna won an outside scholarship that was $1000. Consequently, Duke will use the outside scholarship to reduce student loans.

- Work study: $2,200

- Student loans: $4,000 ($5000 (initial) - $1000 (scholarship) = $4000)

- Duke grant: $30,000

- Total Aid: $37,200 (remains the same)

Example 3

Carlos is a Junior and received the same financial aid package as Alex and Anna. However, Carlos won an outside scholarship of $8,000. Consequently, Duke will use the outside scholarship to reduce work-study, student loans, and grants.

- Work study: $0 ($2200 (initial) - $2200 (scholarship) = $0)

- Student loans: $0 ($5000 (initial) - $5000 (scholarship) = $0)

- Duke grant: $29,200( $30000 (initial) - $800 (scholarship) = $29,200)

- Total Aid: $37,200 (remains the same)

Work-study is a great option, but wouldn't you rather spend more time focused on your studies and future career? Unlock the power of scholarships with Bold.org and potentially cover your work-study amount with financial aid.

How to Pay Tuition at Duke University?

Initiative for Students from the Carolinas

Although Duke has policies that make outside scholarship money less useful than that of other institutions, don't let it discourage you from applying. Duke can still provide financial assistance to its students through a full tuition scholarship.

Duke has a program called Initiative for Students from the Carolinas, in which all undergraduate students residents in North and South Carolina are eligible to receive full tuition grants if their family's household income is $150,000 or less.

Additionally, students that have a family total income of $65,000 or less will receive full tuition assistance, plus assistance for housing, meals, and some course materials or other expenses without the need for a student loan.

For the Initiative for Students from the Carolinas, students whose family's income fluctuates will have their income verified each year. Therefore, if the income of students is higher than $65,000, they may not qualify for additional help like housing and meal plan assistance. If a student's family income surpasses $150,000, the student may no longer qualify for tuition grants. Make sure to check what specific aid packages you qualify for based on your family income.

Conveniently, proof of residency is only required once, and if a student's family moves to a state other than North Carolina or South Carolina, they will maintain their eligibility.

The financial aid office at Duke University considers the full institutional grant to be at least the cost of Duke tuition. For instance, in the academic year 2024-2025, the tuition is projected to be $66,326. Thus, students who are eligible for the program will receive a grant of the same amount, meaning they don't have to pay the annual tuition.

Grant Aid

Besides the Initiative for Students from the Carolinas, students can also receive grant aid. This aid can come from various sources, such as institutional grants and government grants, like Pell grants, and can also benefit out-of-state students. The grants are given to college students as need-based aid, so students who show more financial aid need are likely to receive more financial help.

Merit Scholarships

Duke offers students the possibility of winning a merit scholarship. Most merit scholarships at Duke's don't require an application process, the only two that need are Robertson scholarship and Nakayama scholarship. The merit scholarship will help students cover the cost of attendance of tuition, exact housing charges, standard meal plan, and mandatory fees.

Tuition Benefits

Duke University also accepts tuition benefits. These benefits come from employers like Duke University, and employees or their dependents are eligible to receive the benefits. However, understanding how the benefits will affect the total financial aid is vital.

Let me explain:

Example 1

Mary does not have any tuition benefits. Consequently, her eligibility for work-study, student loans, and need-based grants remains unchanged. For instance:

- Tuition benefit: $0

- Work study: $2,000

- Student loan: $5,000

- Need-based Duke grant: $25,000

- Total need-based aid: $32,000

Example 2

Alice has a mother who works for an employer that offers $20,000 in tuition benefits. Consequently, her eligibility for work-study, student loans, and need-based Duke grants changes. For instance:

- Tuition benefit: $20,000

- Work study: $2000

- Student loan: $5000

- Need-based Duke grant: $5000 (25,000 - 20,000)

- Total need-based aid: $32,000

Example 3

Patrick has a mother who works for an employer that offers $40,000 in tuition benefits. Consequently, his eligibility for work-study, student loans, and need-based Duke grants changes. For instance:

- Tuition benefit: $40,000

- Work study: $0

- Student loan: $0

- Need-based Duke grant: $0

- Total need-based aid: $40,000

In the case of Patrick, Duke took out work-study and student loans. However, suppose students are in a similar situation. In that case, you can still contact the university financial aid office and ask if the loan and work-study could be added to their financial assistance account.

Frequently Asked Questions About Duke Scholarship Stacking

What are the requirements to qualify for Initiative for Students from the Carolinas?

To qualify for the financial aid of the Carolinas, independent students must have been residents of one of the Carolinas when they entered Duke for at least 12 months. Dependent students must have been living in one of the Carolinas with their parents for at least 12 months. It is important to fulfill the residency information in the FAFSA form and also have documents that prove that students have been in North Carolina or South Carolina for the required time frame.

Does Duke offer financial Aid for ROTC (Reserved Officer Training Corps) programs?

Duke University offers students the possibility of joining ROTC. There are three ROTC programs, all of which offer financial aid. The ROTC programs are the Air Force ROTC program at Duke, the Army ROTC program at Duke, and the Navy ROTC program at Duke.

Does Duke offer Financial Aid for the AmeriCorps program?

AmeriCorps is a program where students volunteer to help the nation with some of its most pressing challenges. When students serve in AmeriCorps, they have to choose how they want to help society. They could mentor a child, help boost graduation rates, support communities impacted by natural disasters, work to end hunger, or do other similar activities.

Students serving at AmeriCorps can be awarded up to $7,395 if they complete the service full-time. Students who receive awards will see their student loans and work-study reduced before the University grants.

Unlock your full potential with Bold.org scholarships! Apply today and start your journey to a brighter future.