What Does a Negative SAI Mean?

Federal Student Aid evolves over time, just like any other organization. Staying informed about the latest abbreviations and terms related to university financial support is key to discovering opportunities for educational funding—and potentially graduating debt-free. That’s why I’m here to help you understand and answer the question, "What does a negative SAI mean?" while explaining why this term is essential in how the government allocates monetary funds to students.

The FAFSA, or Free Application for Federal Student Aid, is what the government uses to determine your financial aid eligibility through the Student Aid Index (SAI). Starting in the 2024-25 award year, the SAI will replace the Expected Family Contribution (EFC). Unlike the EFC, the SAI is not a dollar figure representing what your family is expected to contribute. Instead, it’s a number used to assess your financial need.

Don't miss your chance! Apply to Bold.org scholarships today.

What Does a Negative SAI Mean: A Guide to Understanding Your Student Aid Index Score

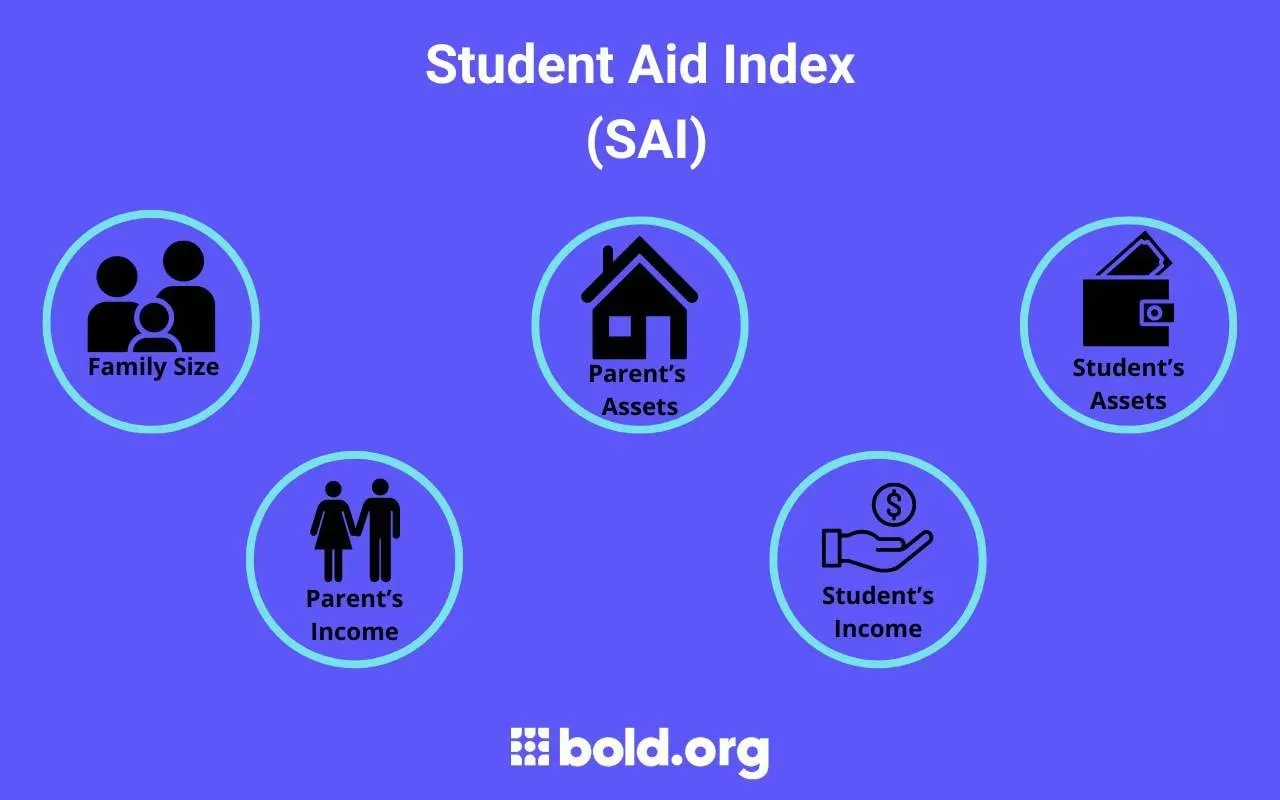

Negative numbers do not always mean that they're bad. In the case of SAI, it could mean that students are eligible to receive more financial support. After filling out the FAFSA form, the government will check the student's information. Some of the information that is critical to determining SAI are:

- Family size

- Parent's income

- Parent's assets

- Student's income

- Student's assets

The system will process the data after the government knows your income and asset reporting. Afterward, you will be able to receive your financial aid award (federal grants, loans, and work-study eligibility).

Understanding the Student Aid Index (SAI)

After you complete all the FAFSA procedures, the system will determine your SAI. SAI is calculated based on income, assets, and other factors, with a range starting at -1500 and varying based on financial circumstances, with no fixed upper limit. An SAI that is considered good is between negative SAI and zero SAI. The lower your SAI, the greater your financial need and the greater your chances of receiving more economic support, such as a Pell Grant.

It would be a great idea to consult official FAFSA documentation for the most accurate range.

Federal Pell grant

One of the best forms of financial aid the government gives is the Pell Grant. The grant is given to students, and the only requirement to verify eligibility is to fill out the new FAFSA form. After that, the system will calculate your Pell grant.

Here are the three ways in which a student can qualify for a Pell Grant:

- Maximum Federal Pell Grant

- Minimum Federal Pell Grant

- Calculated Federal Pell Grant according to SAI.

Eligibility for a PELL grant is determined by the student's financial dependence. There are dependent students whose parents support them financially and independent students who don't have financial support. A student will receive financial support accordingly.

Get Matched to Thousands of Scholarships

Create your Bold.org profile to access thousands of exclusive scholarships, available only on Bold.org.

Create Free ProfileMaximum Pell Grants

To qualify for the maximum Pell Grant, students must meet at least one specific criterion of the following:

- The student is not required to file taxes.

- Dependent students with single parents must have a family-adjusted gross income (AGI) below 225% of the federal poverty guideline, or students with married parents must have an AGI below 175%.

- Single independent students must earn less than 325% of the poverty guideline or 275% if they are married.

It's important to note that students not required to file taxes may qualify for the maximum Pell Grant, but additional criteria, like adjusted gross income and family size, are also considered.

Minimum Pell Grant

To qualify for a minimum Pell Grant, students must meet at least one specific criterion of the following. First, dependent students with single parents must have a family-adjusted gross income below 325% of the poverty guideline, or students with married parents must have an income below 275%. Second, independent students must earn 400% of the poverty guideline when they are single parents, 350% if not single, and 275% if not a parent. The income threshold is based on family size and state wealth.

Calculated Pell Grant Based on SAI

If a student does not belong to the cases mentioned, they will have a calculated SAI. The formula is calculated as pell = max pell minus SAI.

Percentages of poverty guidelines are used to determine minimum Pell Grant eligibility, but specific applications of these thresholds depend on factors like family size and income, making it helpful to consult official poverty guideline tables for clarity.

For more information on the above guidelines, please refer to the Student Aid Index (SAI) and Pell Grant Eligibility Guide.

Financial Aid Amount

All right, now you understand how SAI works, and to receive more financial aid support, an SAI that is negative can mean that you will receive more help. However, this is only some of the information you need to know. The school's financial aid office makes the final decision on the financial aid amount a student receives.

For example, if you filed the FAFSA for the 2023-2024 year, the school will use the expected family contribution (EFC) to determine the educational funds a student will receive. However, if you filed the new FAFSA form, which was the most recent one for the 2024-2025 year, the school will use the SAI. After your school knows whether they use EFC or SAI, they will subtract that from the cost of attendance (COA).

While SAI serves as a guideline for federal aid eligibility, schools ultimately determine financial aid packages based on factors such as Cost of Attendance and institutional policies.

Cost of Attendance (COA)

The cost of attendance estimates the overall college expenses. Among the items considered for COA estimation are tuition, fees, housing, food, books, transportation, allowance for child care or other dependents, costs related to disability, and reasonable costs related to studying abroad.

Fictitious Case Studies

I've created fictitious examples of students in the U.S. to help you better understand how SAI works. This will allow you to see which case is closer to you and prepare you to analyze the financial investment needed for your education.

Low-Income Single Parent

An example of a student who receives negative SAI is a single mother. For instance, Mary works part-time while attending Community College and has two children. Due to her income and number of dependents, she has a negative SAI and is eligible to receive the maximum PELL grant and other financial aid support. Consequently, she can find more time to study.

Dependent High-Income Student

A contrary example to Mary would be Anderson, who is a dependent student from a wealthy family and attends a private University. The family has assets and income that will result in a positive SAI. As a consequence, Anderson may receive less or no financial support, but Anderson can still apply for scholarships or private loans.

Independent Student with Moderate Income

A middle-ground case between Mary and Anderson would be Anna. Anna is a full-time employee and also a college student. Her income covers her necessities but does not cover other educational expenses. Therefore, Anna has a zero SAI, which means that she does not qualify for the maximum PELL grant but is still eligible to receive financial aid to help her educational endeavors.

While the fictitious case studies are useful for illustrating different financial aid scenarios, they may oversimplify complex factors, such as how Anna's zero SAI could still result in varying aid amounts depending on her institution's Cost of Attendance.

These scenarios are used for illustration purposes; actual financial aid eligibility may involve additional variables.

Scholarships

Although SAI is essential to understand the financial support a student will receive, Bold.org encourages students to apply for scholarships continuously. Winning a scholarship can make a huge difference in your education since scholarships can pay for your whole tuition. Merit-based and need-based scholarships can come from various sources, such as:

- Universities: Many universities offer scholarships to ease their students' financial burdens. For information, contact the University's financial office.

- Private Organizations: Many organizations, such as non-profits, offer scholarships that can be merit-based, community service-based, or need-based. Research them at Bold.org.

Persistence is key to finding scholarships that suit you. Start researching and applying early by tailoring your application to the scholarships that most align with you. It is important to show originality in your application and tackle the essay prompts. Strong recommendation letters are also highly recommended to increase your chances.

Create Your Free Profile to Apply for Scholarships Today!Frequently Asked Questions About Negative SAI

What happens if I make a mistake on my FAFSA?

If you have made a mistake on your FAFSA form, don't panic. The form is long, and often, students/parents take time to find all the information requested by the government. Knowing that federal student aid has provided ways for students to correct their application:

- Log in to your Studentaid.gov account. Independent students can change the account, but dependent students need a parent's electronic signature using their Studentaid.gov account.

- Students who have received the FAFSA submission summary by mail can make the changes in the paper document, sign it, and send it to the address listed.

- Students can also contact their college and ask them to make the changes.

Corrections to the FAFSA can be made within specific deadlines, and students should check with their school or Studentaid.gov to ensure timely updates. Specific deadlines vary yearly and should be verified for accuracy. Similarly, priority FAFSA submission deadlines differ by state and institution.

Can I appeal my financial aid package?

Yes, students can appeal their financial aid package. However, students are more likely to receive more financial aid if they have a change in their family or face different economic circumstances. To appeal a financial aid package, students should provide supporting documentation, such as proof of medical bills, unemployment, or significant income changes.

How often do I have to submit the FAFSA form?

Students should resubmit their FAFSA form every year to ensure they receive more financial aid and also keep the system up-to-date, which in some cases could no longer affect eligibility for aid. Students are likely to get a better financial aid package if they submit the FAFSA as early as possible.

After reviewing your appeal, the college will analyze your current financial need and decide whether to give more aid. Students can find more information on their college financial aid website, or you can talk to the staff at the office if you want more information. The office may have more detailed information, such as if they included expenses related to the cost of a laptop or student health insurance in their financial aid package.

Head over to our Scholarship Blog to learn more about financial processes, scholarships, and more!