Can Graduate Students Get Pell Grants in 2025?

The short answer is yes (but only in unique situations). Pell Grants can alleviate some personal expenses and tuition costs if you are enrolled in specific postbaccalaureate programs. Unlike traditional student loans, this form of financial aid does not need to be repaid when awarded, and it helped me avoid getting more student loans.

So, if you need to fill out your federal student aid FAFSA application for graduate school, I will explain eligibility requirements, how a Pell Grant might help reduce student loans, and other alternatives to finance graduate school.

Looking for financial aid resources? Bold.org has thousands of scholarships for graduate school.

Understanding Pell Grants for Graduate School and Undergraduate Students

Pell Grants are a form of federal financial aid that assists students in funding their education. Although these grants are specifically designed for eligible undergraduate students, there are ways to receive a Pell Grant as a graduate student.

Key Points:

- Exclusivity: Pell Grants are primarily for those pursuing their first undergraduate degree.

- Financial Need: The focus on exceptional financial need aligns with supporting students early in their academic journey.

- Professional Degrees: Graduate students, including those pursuing professional degrees, usually do not qualify for Pell Grants due to the program's undergraduate focus, with some exceptions.

Understanding this distinction helps clarify why graduate students often need to seek alternative sources of funding.

Create your free profile to apply for Grad School Scholarships today!Features of Pell Grants

- Need-based Aid: Unlike loans, Pell Grants do not need to be repaid, making them an attractive option for students from low-income households.

- Eligibility Criteria: Students must demonstrate significant financial need through the Free Application for Federal Student Aid (FAFSA) to qualify.

- Funding Amounts: The grant amounts can vary each year and depend on factors like the student's financial need, cost of attendance, and enrollment status.

Eligibility Requirements

Pell Grants are intended to help eligible students who have not yet earned a bachelor's or graduate degree. Eligibility for federal funding is primarily determined by a family's Expected Family Contribution (EFC), now considered the Student Aid Index, which is calculated using the information provided in the FAFSA form. The higher the financial need you have, the higher the likelihood of qualifying and receiving a larger Pell Grant. This system ensures that aid is directed towards those with the greatest financial need.

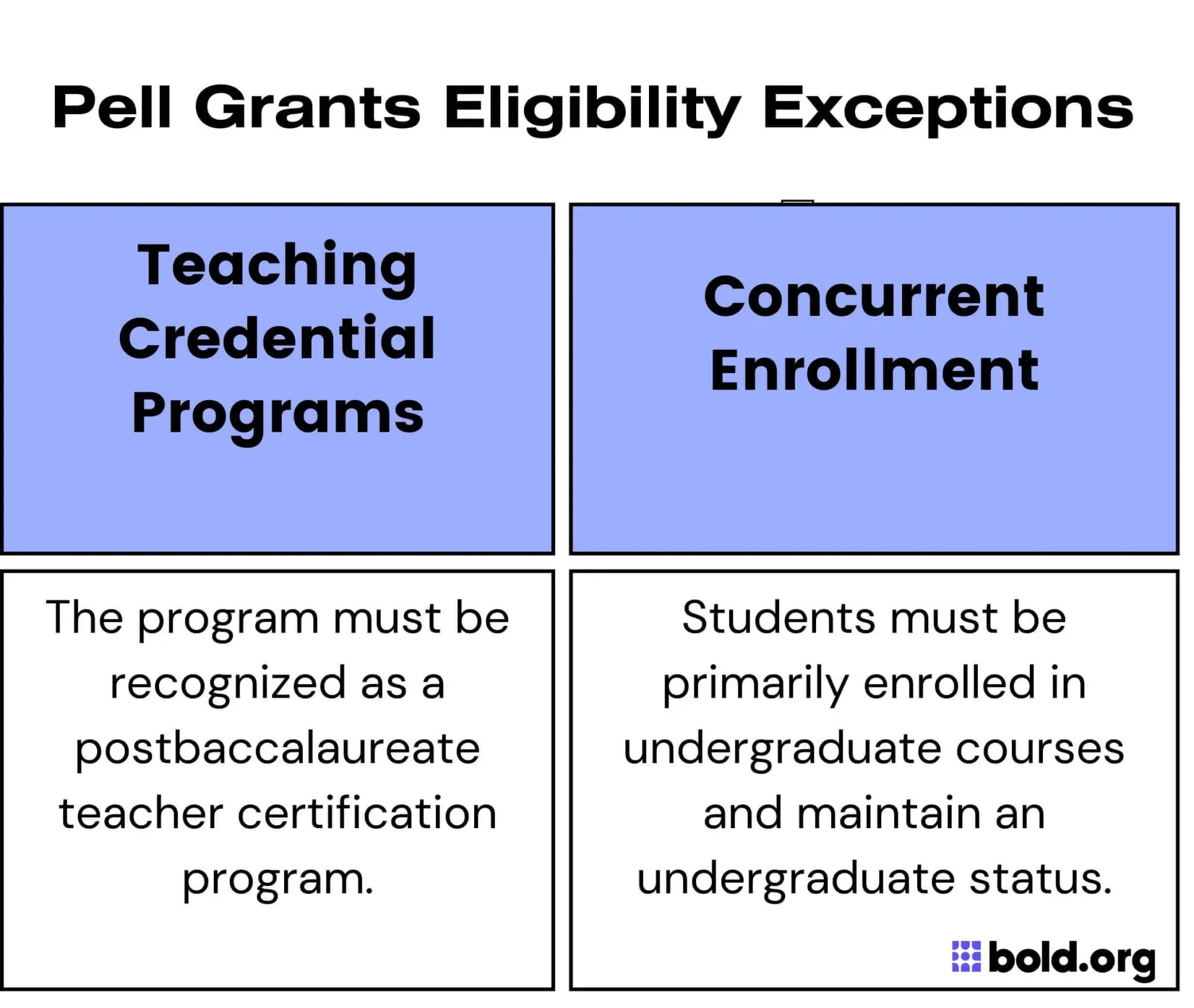

Exploring Graduate Students Exceptions for Eligibility

While graduate students generally do not qualify for Pell Grants, there are specific exceptions where they might still meet the eligibility criteria. Here are some of the special cases to receive a Pell Grant for graduate school.

Postbaccalaureate Program

One exception is students enrolled in certain postbaccalaureate programs. These are non-degree programs taken after completing a bachelor's degree. A common example is students pursuing their first teaching credential through a third school or teacher certification program. In such cases, they may be eligible for Pell Grants as long as the program does not lead to a bachelor's or graduate degree.

Concurrent Enrollment

Another scenario involves concurrent enrollment, where graduate students qualify and are enrolled in both undergraduate and graduate courses simultaneously. Suppose the first graduate student enrolled still needs to complete their bachelor's degree and is primarily considered an undergraduate. In that case, they might qualify for Pell Grants based on their undergraduate status.

These cases highlight that while Pell Grants are predominantly for undergraduates, there are unique situations in which graduate students could still benefit. It's crucial to consult with your institution's financial aid office to understand specific eligibility requirements and apply accordingly.

Get Matched to Thousands of Scholarships

Create your Bold.org profile to access thousands of exclusive scholarships, available only on Bold.org.

Create Free ProfileSo, Can Grad Students Receive Pell Grants as Federal Student Aid?

In general, advanced degrees are not covered by Pell Grant funding. This is because the structure of financial aid programs prioritizes providing assistance for initial access to higher education rather than more than one school or furthering education beyond the undergraduate level. However, as demonstrated above, there are exceptions.

Alternative Federal Programs for Financial Assistance

While Pell Grants may not be available for graduate students, various federal programs offer financial assistance tailored to support them in advanced studies. These initiatives can significantly ease the financial burden of low-income graduate education students.

Graduate students can also apply for scholarships, which aren't available to students of lower grade levels. Criteria of these scholarships will vary between opportunities, so browse through this list of graduate school scholarships to find the right one for you.

Federal Work-Study (FWS) Program

The Federal Work-Study program provides part-time employment opportunities for graduate students with demonstrated financial need. The program allows the federal government to pay them money to help cover educational expenses. Positions in the work-study program often align with the graduate student's field of study, offering both financial aid and valuable work experience.

Direct Unsubsidized Loans

Unlike Pell Grants, Direct Unsubsidized Loans are not need-based. Graduate students can borrow these federal loans to cover tuition and other educational costs. Interest accrues from the time the loan is disbursed, but they offer flexible repayment plans post-graduation.

Graduate PLUS Loans

Graduate PLUS Loans are another other federal aid option, catering specifically to graduate and professional students. These loans require a credit check but allow borrowing up to the cost of attendance minus any other financial aid received. They also come with flexible repayment options and deferment opportunities.

TEACH Grants

For those pursuing a career in education, TEACH Grants provide up to $4,000 per year in exchange for a commitment to a professional degree teaching program in a high-need field at a low-income school for at least four years. This grant is available to both undergraduate and graduate students enrolled in eligible professional degree programs.

Federal programs such as these provide multiple pathways for securing financial assistance. They ensure that even when Pell Grants aren't enough, funds aren't an option. Graduate students have access to essential resources designed to support their educational journey.

Managing the Cost of Graduate Education

Managing the cost of attendance for graduate education can be challenging, but several strategies can help ease the financial burden. Here are some practical tips:

1. Scholarships and Grants

Seek out scholarships and grants specifically designed for top graduate schools and students. Websites like Bold.org offer extensive databases of funding opportunities and scholarships for graduate students.

2. Assistantships and Fellowships

Many universities provide teaching or research assistantships that cover tuition costs and offer a stipend. Fellowships are another excellent option, which often come with fewer responsibilities than assistantships.

3. Part-Time Work

Balancing a part-time student part-time job with your studies can help manage daily living expenses well. On-campus employment often provides flexible hours that fit well with academic schedules.

4. Budgeting Effectively

Create a detailed budget to track your income and expenditures. Prioritize essential expenses and look for areas where you can cut costs.

5. Student Loans

Federal student loans often have lower interest rates and more flexible repayment options than private loans. Consider them a last resort after exploring other funding sources.

6. Utilize Campus Resources

Many institutions offer resources like discounted transportation passes, free software, or subsidized health insurance that can reduce overall costs.

Adopting these strategies can make managing the cost of undergraduate courses, private student loans, and grad school attendance more feasible while pursuing your advanced degree.

Many institutions offer resources like discounted transportation passes, free software, or subsidized health insurance that can reduce overall costs.

Frequently Asked Questions About Whether Grad Students Can Get Pell Grants

What specific postbaccalaureate programs are eligible for Pell Grants?

Graduate students might be eligible for Pell Grants if they enroll in specific postbaccalaureate programs, such as teacher certification programs that do not lead to a master's degree. These programs must be recognized for certification or licensure in the state where students plan to teach. This eligibility is an exception to the general rule.

What are the requirements for maintaining eligibility for TEACH Grants?

To maintain eligibility for TEACH Grants, graduate students must agree to teach full-time in a high-need field at a low-income school for at least four years within eight years of completing their program. Failure to meet these requirements will convert the grant into a Direct Unsubsidized Loan, which must be repaid with interest.

What are some alternative financial aid options for graduate students?

Graduate students can explore several other financial aid options, including Federal Work-Study programs, Direct Unsubsidized Loans, Graduate PLUS Loans, and TEACH Grants. Additionally, many universities offer assistantships and fellowships that provide both financial support and valuable work experience.

How can I manage the cost of graduate education effectively?

To manage the cost of graduate school's financial aid office and education, consider seeking out scholarships and grants specifically for graduate students, applying for assistantships or fellowships, balancing part-time work with studies, creating a detailed budget, and utilizing campus resources such as discounted transportation passes and subsidized health insurance.

What steps should I take to apply for financial aid as a graduate student?"

Graduate students should start by completing the FAFSA to determine eligibility for federal aid, including loans and work-study programs. They should also research and apply for scholarships, grants, and assistantships specific to their field of study. Additionally, meeting with a financial aid advisor can provide personalized guidance and information about available resources.

Looking for additional resources to navigate grad school yourself? Bold.org has thousands of helpful tips to finance your education.