What Is a 1098-T? A Guide to Understanding This Tax Form

Tax season is here... is anyone already stressed out? I know firsthand how overwhelming filing your taxes can be, especially when you're facing the possibility of unexpected financial losses. Not to mention the unfamiliarity of important forms and documents like a 1098-T.

Just the name of the document intimidates me. But if you're anything like me, you're going to want to learn about what a 1098-T is and how it relates to your taxes. So, if your 1098-T form just came in, and you're wondering what any of it means, you've come to the right place.

In this guide, I'm going to go over the basics of a 1098-T form, break down its purpose and structure, and talk about who needs it. I'll also discuss how to use a 1098-T form for tax filing and highlight the common mistakes to avoid. So, let's explore 1098-T forms and set ourselves up for a successful tax filing season together!

Create a free Bold profile to start applying for scholarships today!

Definition of a 1098-T Form

Let's start with the basics. A 1098-T form, or tuition statement, is an American IRS tax form filed by eligible education institutions to report payments received and payments due from paying students.

The institution is required to report a form for every student who is currently enrolled and paying qualifying tuition and related expenses to attend their school. At the beginning of the next tax year, students currently enrolled in a college/university will receive their 1098-T form to include in their yearly taxes.

Purpose of a 1098-T Form

The main purpose of a 1098-T form is to provide tax advice and help taxpayers determine their eligibility for certain education-related tax benefits, like the American Opportunity Credit or the Lifetime Learning Credit. It also provides important information regarding education expenses that may be used to reduce taxable income or claim tax credits.

For students, the 1098-T form serves as a breakdown of their educational expenses, allowing them to keep track of their investments. This information can be particularly useful when applying for scholarships or grants, as it provides concrete evidence of the financial commitment made towards education.

For parents, the 1098-T form can also be a valuable resource to see who may be eligible to claim education-related tax credits. By accurately reporting the qualified education expenses, parents can potentially get academic credit, reduce their tax liability, or even receive a refund. This can greatly alleviate the financial burden of supporting a child's education.

Get Matched to Thousands of Scholarships

Create your Bold.org profile to access thousands of exclusive scholarships, available only on Bold.org.

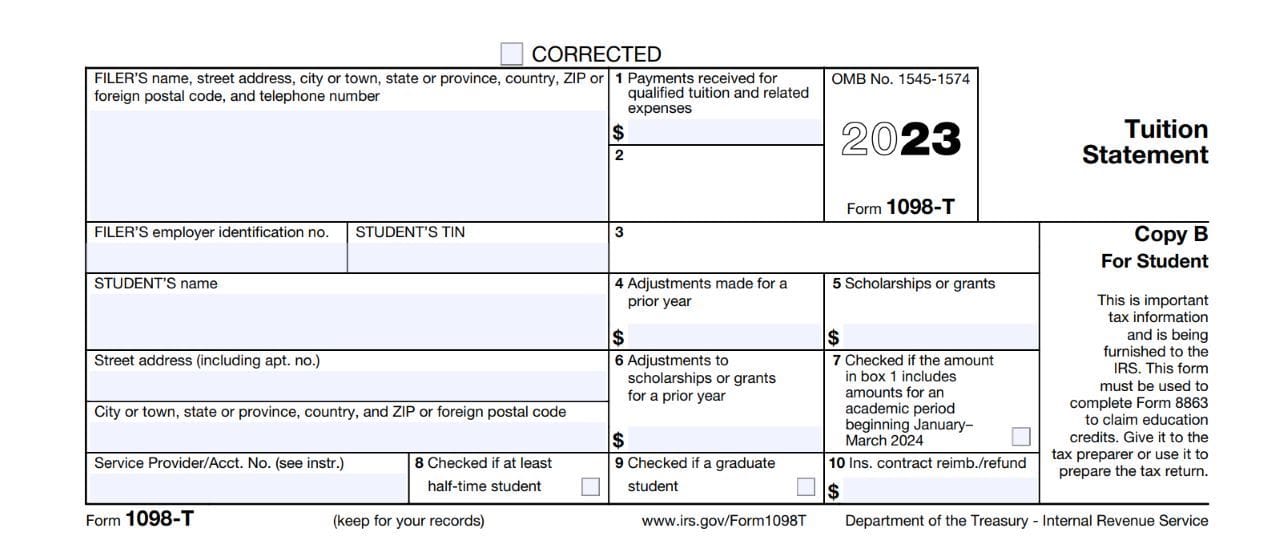

Create Free ProfileThe Structure of a 1098-T Form

For many people, tax season is a stressful time of year. Between receiving a 1098-T form and other tax return documents, not only is it difficult to keep up with them, it's even more difficult to understand them at first glance. Let's break down the structure of the 1098-T form to ensure full comprehension of its components for this year's tax season.

Key Components of a 1098-T Form

We know the 1098-T is a tuition statement, but it's comprised of specific sections that provide important details about your educational expenses and enrollment.

These sections include:

- Student Information: This section includes your name, address, and Social Security number or taxpayer identification number.

- Institution Information: This section is for your educational institution's name, address, and tax identification number.

- Box 1: This box displays the total amount of qualified tuition and related expenses received by you during the tax year by the educational institution.

- Box 2 & 3: These boxes are no longer used.

- Box 5: In this box, your school reports the total amount of scholarships or grants it administered during the tax year. Please note: Scholarships and grants may affect the amount of your qualified education expenses.

For a comprehensive review of each box, please review the IRS website.

Reading a 1098-T Form

To make the most of this form, it's important to pay close attention to the information provided in each box. Understanding how the amounts in Box 1, Box 2, and Box 5 contribute to your tax situation is key to maximizing your tax benefits.

- Box 1: This box displays the total amount of qualified tuition and related expenses a student paid to their school during the tax year. This information is going to determine whether you are eligible for education-related tax credits or deductions. However, it's important to note that the amount in Box 1 may not accurately represent the actual payments you made. It is based on the expenses billed, which may differ from the amount you paid out of pocket.

- Box 2: This box reports the total amount of scholarships or grants administered by each department of your educational institution during the tax year. Scholarships and grants can help reduce your qualified education expenses, potentially affecting the amount of tax benefits you can claim. It's crucial to understand how these amounts impact your overall tax situation.

- Box 5: Provides information on the total amount of scholarships or grants that are considered taxable income. This information is vital for determining your tax liability. If you received scholarships or grants for college that are taxable, you may need to report them as income on your tax return.

I know this can seem like a bit of information overload, so if you have any questions or concerns about the information on your 1098-T form, don't hesitate to reach out to your school's financial aid office. They are there for clarification and to assist you in accurately interpreting the form.

Who Needs a 1098-T Form?

As I mentioned before, at the beginning of each new tax year, students will receive their 1098-T form to include in their filing, but is the 1098-T form limited to just students?

Eligibility for a 1098-T Form

Generally, if you are a U.S. citizen or resident alien who paid qualified education expenses during the tax year and attended school at an eligible educational institution, you will likely receive a 1098-T form.

However, there are a few exceptions:

- Nonresident aliens: If you're a nonresident alien, you may not receive a 1098-T form unless specifically requested by you or your tax preparer. It's essential to consult with a tax professional to understand your tax obligations in this situation.

- Expenses fully covered by scholarships or grants: If your qualified education expenses were fully covered by scholarships, grants, or employer tuition assistance, you may not receive a 1098-T form. However, it's still important to keep documentation of these transactions for your records.

If you fit the bill for a 1098-T form, your school will typically send it out by January 31st. You may receive it by mail or access it electronically through the school online portal, but once you do receive it, be sure to keep this form in a safe place, as you'll need it when filing your taxes.

How to Obtain a 1098-T Form

As I mentioned, to qualify for the 1098-T form, you must be a U.S. citizen or resident alien. But what exactly does it mean to be a resident alien? Well a resident alien is an individual who is not a U.S. citizen but meets either the green card test or the substantial presence test.

The green card test is relatively straightforward. If you have been granted permanent residence in the United States by the U.S. Citizenship and Immigration Services (USCIS) and have an alien registration card, also known as a green card, you are considered a resident alien for tax purposes.

But unlike the green card test, the substantial presence test is a bit more complex. This test takes into account the number of days you have been physically present in the United States over a three-year period, including the current year.

To pass the substantial presence test, you must be physically present in the U.S. for at least 31 days during the current calendar year and a total of 183 days during the three-year period. Your residency is calculated using a specific formula provided by the Internal Revenue Service (IRS).

Please note: if you are a nonresident alien and meet the substantial presence test, you will be considered a resident alien for tax purposes. This means that you may receive a 1098-T form if you meet all other criteria.

However, even if your qualified education expenses were fully covered by scholarships, grants, or employer tuition assistance, it's crucial to keep track of these documents in a safe and secure place. These documents serve as evidence of your financial situation and can be helpful when applying for student aid programs, scholarships, or even future tax purposes.

So, make sure to keep your 1098-T form safe and easily accessible when tax season rolls around.

How to Use a 1098-T Form for Tax Filing

Now that we're familiar with the 1098-T form and its contents, it's time to apply it to your tax filing. But how exactly? Let's talk about it.

Reporting Education Expenses

Just as a reminder, using a 1098-T form for tax filing can help you determine if you're eligible for valuable tax credits. So, when it's time to file your tax return, you'll need to report your education expenses accurately. These expenses (found in Box 1 of your 1098-T form) are deductible on your federal tax return.

These expenses include tuition, fees, and other related expenses paid to an eligible educational institution. However, keep in mind that not all expenses are considered qualified educational expenses. For example, room and board, transportation, and personal expenses are generally not eligible for deduction.

Claiming Education Credits

In addition to deducting qualified education expenses, you may also be eligible to claim education-related tax credits. The two main credits available are the American Opportunity Credit and the Lifetime Learning Credit.

The American Opportunity Credit is a tax credit of up to $2,500 per eligible student per year and is available for the first four years of post-secondary education. This credit is partially refundable, meaning you may receive a refund even if you don't owe any taxes.

The Lifetime Learning Credit offers a credit of up to $2,000 per tax return and is available for an unlimited number of years. This credit is nonrefundable, meaning it cannot exceed the amount of tax you owe.

I know understanding the complexities of education-related tax credits can be challenging, so I recommend consulting a tax professional who specializes in education tax benefits for guidance and the IRS website.

A tax professional can help you understand the nuances of the various education tax credits and laws and assist you in accurately reporting your education expenses, helping you make the most of your tax return. Literally!

Common Mistakes to Avoid with a 1098-T Form

Filing new forms can be tricky for first-time filers, and the last thing I want for you to do is fill your 1098-T incorrectly, so let's go over a couple of common mistakes to avoid when completing your 1098-T.

Incorrect Information on a 1098-T Form

A 1098-T form can be a valuable resource when filing your taxes, so it's crucial to make sure all of the information is correct. Mistakes or discrepancies on the form can lead to errors on your tax return, potentially triggering audits and causing delays in processing.

Take your time when reviewing your 1098-T form carefully, making sure that your personal information, your school's details, and the reported amounts are correct. If you notice any errors or have concerns, reach out to your financial aid office promptly to get the necessary corrections made.

Missing the Deadline for a 1098-T Form

Another common mistake to avoid is missing the deadline for receiving your 1098-T form. Schools are required to issue the form to students by January 31st of each year. If you don't receive your form within a reasonable timeframe, you may have to request a copy directly from your school. This will not only cause unnecessary delays but can also create potential complications when filing your taxes.

Overall, understanding the 1098-T form and how to utilize it can make a huge difference in your tax filing process. If you familiarize yourself with its purpose, structure, and requirements, you can take full advantage of education-related tax benefits and avoid common pitfalls. Remember, if you have any questions or concerns about your 1098-T form, ask your financial aid officer or tax accountant for help. Happy filing!

Frequently Asked Questions About the 1098-T Form

What are qualified education expenses?

Qualified expenses include payments for tuition, fees, and other related expenses required for the enrollment or attendance of an eligible student at eligible educational institutions. These expenses must be incurred for an academic period that begins within the tax year or during the first three months of the subsequent tax year.

Note: It's important to consult IRS guidelines or a tax professional for the most current and applicable rules for qualified education expenses related to tax credits and deductions.

What is a common mistake to avoid when filling out your 1098-T form?

In order for your taxes to be filed accurately, it's important to pay attention to everything filled out in the required boxes. If the information is incorrect, it can flag auditors and cause unnecessary delays when filing. I recommend going over the form to ensure 100% accuracy, and if you want a second set of eyes, ask a financial aid officer, tax accountant, or parent to review it, as well.

Do parents receive 1098-T forms?

College students or their parents who paid expenses for qualified tuition and related college costs may receive Form 1098-T. If your parents can claim you as a dependent, they will get the education credit.

Sign up for a free Bold profile today to apply for our exclusive scholarships. Head over to our Scholarship Blog to learn more about the IRS form 1098-T, other tax information, and college life.