Tax Deductible Donations

Charitable donations lower your income tax expense and support organizations or causes that improve the world.

Charitable contributions are one of the best ways to save money on taxes. Individuals and businesses can deduct cash and property donations from qualified charitable organizations. A charitable contribution deduction gives a donor a tax break through charitable giving, benefitting both the donor and the donor-recipient.

In short:

- Donations to tax-exempt organizations are tax-deductible.

- Contributions must go to 501(c)(3) non-profits like the Bold Foundation.

- Documentation and receipts are required to claim deductions.

Here's what we'll cover:

- Are Charitable Contributions Taxable Income?

- Can I Receive a Tax Deduction for Scholarship Donations?

- How Much of a Donation is Tax Deductible?

- How to Claim Tax-Deductible Donations on Your Tax Return

- What Charitable Donations Aren't Tax Deductible?

Keep reading to learn how charitable contributions can reduce your taxes, what rules to follow when donating, and how Bold.org makes educational donations easy.

1. Are Charitable Contributions Taxable Income?

Donations to qualified organizations are tax-deductible.

Donations of money or goods to a tax-exempt organization, such as a charity, are tax deductible. Therefore, donations that are tax-deductible can help to reduce taxable income. Donations are only taxable income if the donor receives something in return for their contribution, such as a service or product. You will only be eligible for tax deductibles if you donate to qualified organizations.

2. Can I Receive a Tax Deduction for Scholarship Donations?

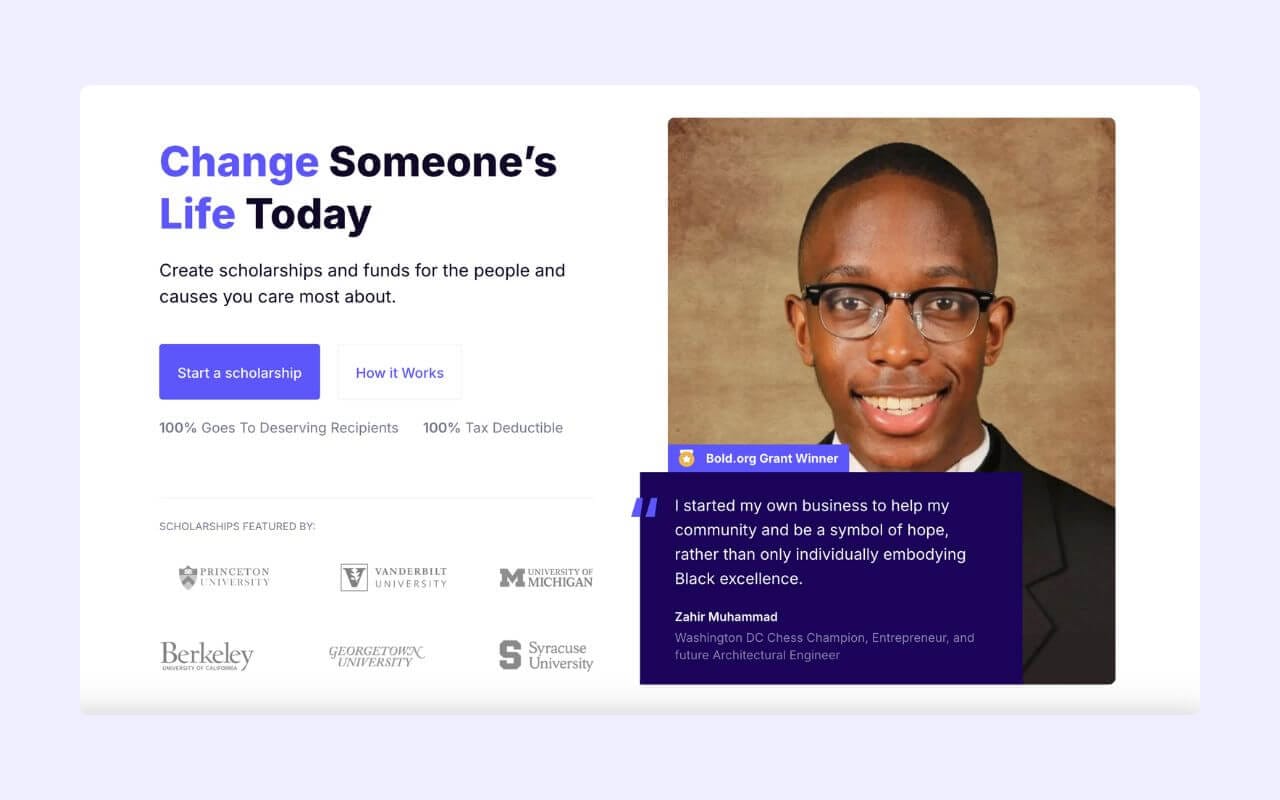

Bold.org simplifies the donation process for donors, making it easy to create and contribute to tax-deductible scholarship funds.

Scholarship donations are tax-deductible if you donate to a qualified organization. At Bold.org, we work hard to fight student debt by helping students find funding for post-secondary school.

Scholarships are amazing tax deduction donations as they benefit donors and recipients alike. By creating scholarships with Bold.org, you can maximize your impact on the college community and receive charitable tax deductions.

You can make an impact by creating a scholarship and donating to the Bold Foundation, a 501(c)(3) non-profit. When your donation is processed, you’ll receive an email with documentation confirming your tax-deductible donation. 100% of your donation will go directly to the educational costs of the winners you select and is 100% tax-deductible.

3. How Much of a Donation is Tax-Deductible?

Your tax-deductible charitable contribution depends on the type of donation, the organization, and your adjusted gross income.

Your charitable contribution deduction is generally limited to 60% of your adjusted gross income. Still, depending on the type of contribution and the organization, you could potentially deduct 20% to 30% or even 50%. Tax deductions will vary depending on the type of donation and the organization you donate to.

A process known as a carryover allows you to generally deduct contributions that exceed the cap on your tax returns over the next five years or until they are completely gone. It's best to speak with a tax expert for tax advice to better understand how you can deduct your charitable gifts.

4. How to Claim Tax-Deductible Donations on Your Tax Return

Donate to a qualified nonprofit and document your charitable contributions to get a tax deduction.

Donations to qualifying charitable organizations are tax deductible and may reduce your taxable income and overall tax bill if you follow IRS guidelines.

Donate to Qualifying Organizations

To deduct donations, you must donate to qualifying organizations. You can make a tax deduction on your tax return by donating directly to one of the following types of organizations:

- Nonprofit religious group

- Nonprofit educational group

- Nonprofit charitable group

These organizations are frequently referred to as 501(c)(3) organizations (Bold.org is a 501(c)(3) organization).

Charitable tax deductions cannot be made if you simply donate to someone in need. Publication 526 explains how to claim charitable deductions.

Document Your Charitable Donations

Before you can deduct charitable contributions from your tax bill, you must itemize deductions on your tax return each year to deduct charitable donations from your income. As a result, Schedule A must be completed concurrently with your tax return.

If you itemize, you can generally deduct charitable contributions of cash or property. If you donate property, your deduction usually equals the property's fair market value.

5. What Charitable Donations Aren't Tax Deductible?

Nonprofit organizations and types of donations must comply with IRS guidelines to qualify for deductions.

Deductions are only permitted for charitable contributions, according to tax law. A recipient organization must meet the requirements of the tax code and be determined by the Internal Revenue Service to be tax-exempt (IRS). Gifts to non-qualified charities or nonprofits are not tax deductible. Only money that is actually given is deductible, not money that is pledged or promised.

Donations of cash without a receipt cannot be deducted. Cash donations of more than $250 must be accompanied by a letter from the organization. Non-cash donations require supporting documentation as well.

The IRS Tax Exempt Organization Search tool can help verify whether an organization is tax-exempt and determine its eligibility for deductible charitable contributions.

Frequently Asked Questions About Tax-Deductible Donations

1. How do I determine my tax bracket?

Each taxpayer is assigned a tax bracket. Federal tax brackets are determined by taxable income and filing status. You want to first identify your filing status and then calculate your taxable income to determine your tax bracket. To figure out your taxable income, start by adding your earnings. Then, subtract tax adjustments to determine your adjusted gross income. Then, subtract your deductions.

2. Can I claim donations without receipts?

Yes, you can claim charitable donation deductions even if you don't have a donation receipt. However, there are some restrictions on the donation, such as cash limits and the type of donation.

3. Can you claim donations from previous years?

No, you can only claim credits and deductions in the tax year in which they apply, and income must be reported in the tax year in which it was received.

Why Create a Scholarship Fund Today?

Creating a scholarship fund can change a student's life by helping them pursue higher education. With online donation platforms, creating scholarships or donating funds is easier than ever.

We highly recommend new donors reach out to our Bold.org Donor Team for support. They can address any concerns you may have and walk you through each step, allowing you to focus on giving back to the community.