Scholarships: A Solution to the Student Debt Crisis

Scholarships have been a source of financial relief for students for decades. As the cost of tuition continues to rise, it has become increasingly difficult for students to afford a higher education, thus resulting in massive increases in student loan debt. According to U.S. News & World Report, in 2009, approximately 68% of college graduates had student loan debt, and in 2022, this figure was 61%. Despite the slight difference, the impact of student loan debt remains significant today.

College costs are higher in the United States than in almost any other country around the world, where college is often free or heavily subsidized. However, with the help of scholarships, students can begin decreasing their student loan debts and embark on their journeys toward their degrees.

Today’s article discusses scholarships as a solution to the student loan debt crisis, how donors can contribute to the solution, and ways Bold.org can support donors.

If you're passionate about supporting higher education, consider becoming a donor at Bold.org to help alleviate the burden of student debt and make a meaningful impact on a student's life.

The Student Debt Crisis & the Importance of Scholarships

The student debt crisis refers to the massive burden of student loan debt that millions of students all over the United States are facing. The total student loan debt has surpassed more than $1.7 trillion, affecting a student’s ability to access education and limiting their opportunities toward achieving academic milestones.

However, scholarships have become a main source of help for students to decrease their debt by providing financial assistance towards their higher education. Not only do scholarships reduce the need for federal loans, but they also lower the debt crisis for students. Scholarships can be used for public universities, private schools, and community colleges and can be applied to all school-related costs like tuition, room and board, supplies, etc.

Awarding scholarships based on factors like merit, financial need, or specific criteria helps organizations, foundations, colleges, and universities support students and their educational goals without causing excessive debt. Scholarships make getting a higher education more accessible and affordable for students from diverse backgrounds, including those who may not have the financial means to pay for college.

By investing in scholarships, donors can empower students to take control of their academic aspirations and contribute to a more equitable and inclusive society.

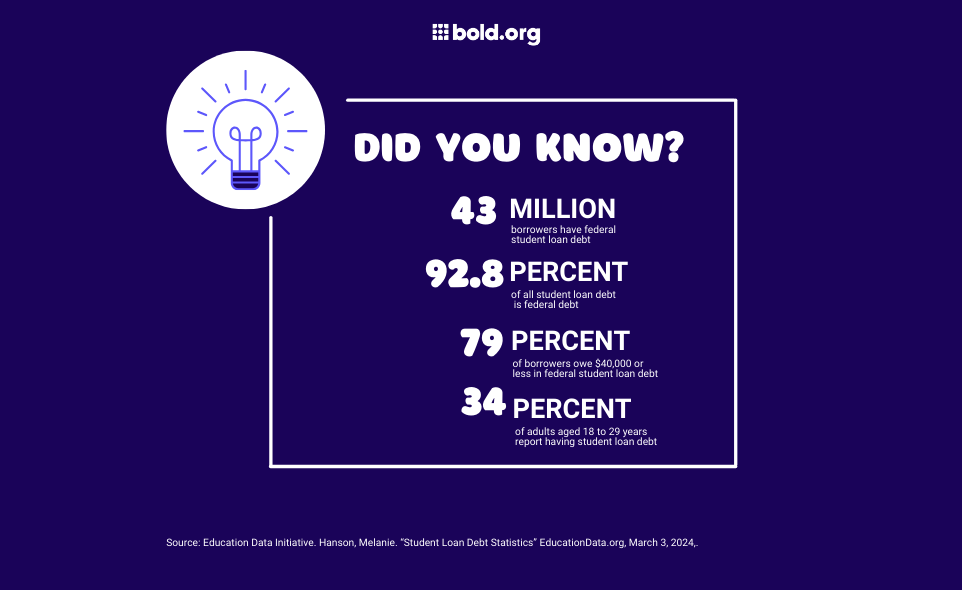

Student Loan Debt Crisis

The current student loan debt crisis in the United States is affecting millions of students all over the country and affecting their ability to get a higher education. In order to fully understand what this debt crisis means, let's discuss some key facts about it:

- Total student loan debt in the U.S. has surpassed $1.7 trillion, making it the second-highest consumer debt category after mortgages.

- As of 2023, the average student loan debt for graduates is over $38,000, with many students owing much more.

- Student loan debt has an uneven impact on minority and low-income borrowers, emphasizing wealth inequality.

- High amounts of student debt can hinder borrowers' ability to achieve financial milestones like home owning, starting a family, saving for retirement, etc.

- Rising tuition, combined with subpar wages and limited job opportunities, has contributed to the student loan debt crisis.

- There are multiple repayment options available to borrowers, like income-driven repayment plans and loan forgiveness programs, but navigating through the system can be challenging for many.

- Addressing the student loan debt crisis requires better structured policy solutions, like increasing access to affordable education, improving loan servicing practices, and exploring options for debt relief.

The National Defense Education Act of 1958

The National Defense Education Act of 1958, a federal law passed in the United States designed at improving access to education in the fields of science, mathematics, and foreign languages. It was enacted in response to the Soviet Union's launch of the Sputnik satellite, which created concerns about the country's technological and scientific capabilities.

The NDE act provided funding for scholarships, loans, and fellowships to support students pursuing higher education in these critical areas. The act also allocated resources for the improvement of educational programs and facilities to enhance national security and competitiveness.

Alleviating the Burden

Scholarships play a crucial role in the student debt crisis by providing financial access to students and reducing their reliance on federal loans. By promoting access to scholarships and expanding opportunities for financial aid, scholarships alleviate the burden of student debt and ensure that all students have equal opportunities to pursue higher education without facing extreme financial challenges.

Exploring Student Debt Solutions

Donors can have an impact on the student debt crisis through a few initiatives. Here are some ways donors can help:

- Funding Scholarships: Donors can contribute to or create scholarship funds that provide non-repayable financial aid to students, reducing the need for loans and helping lower student debt.

- Supporting Loan Repayment Assistance Programs: Donors can support organizations that offer loan repayment assistance programs for student borrowers.

- Investing in Financial Education: Donors can fund financial literacy programs that educate borrowers on how to manage finances, make informed decisions about loans, and understand repayment options.

- Advocating for Policy Change: Donors can support advocacy organizations that work to influence policy changes at the local, state, and federal levels to address student debt issues, such as loan forgiveness programs and improved loan servicing practices.

- Funding Research and Innovation: Donors can support research initiatives and innovative solutions aimed at addressing the root causes of student debt and finding sustainable ways to reduce the burden on borrowers.

By strategically using resources that support and prioritize student debt solutions, donors can make an impact in helping with student loan debt.

Student Loan Forgiveness

In April, President Joe Biden announced new plans to cancel student debt under the Higher Education Act. If implemented, these plans would support the following:

- Cancel up to $20,000 in interest for all borrowers who have accrued or capitalized interest on their loans since entering repayment.

- Automatically cancel debt for borrowers who would otherwise be eligible for loan forgiveness under income-driven repayment (IDR) plans, like the SAVE Plan or Public Service Loan Forgiveness, but are not enrolled in those programs.

- Cancel student debt for borrowers with undergraduate loans who entered repayment at least 20 years ago and debt for graduate school borrowers who entered repayment at least 25 years ago.

- Cancel student debt for borrowers who previously enrolled in low-financial-value programs.

- Cancel student debt for borrowers experiencing hardship that prevents them from fully paying back their loans now or in the future.

These actions are efforts the Biden-Harris Administration has already made to cancel student debt and make loan payments more affordable.

Helping the Student Debt Crisis Through Bold.org

Are you interested in becoming a donor and helping students achieve their academic goals without the debt? Let's discuss ways to help the student debt crisis through Bold.org.

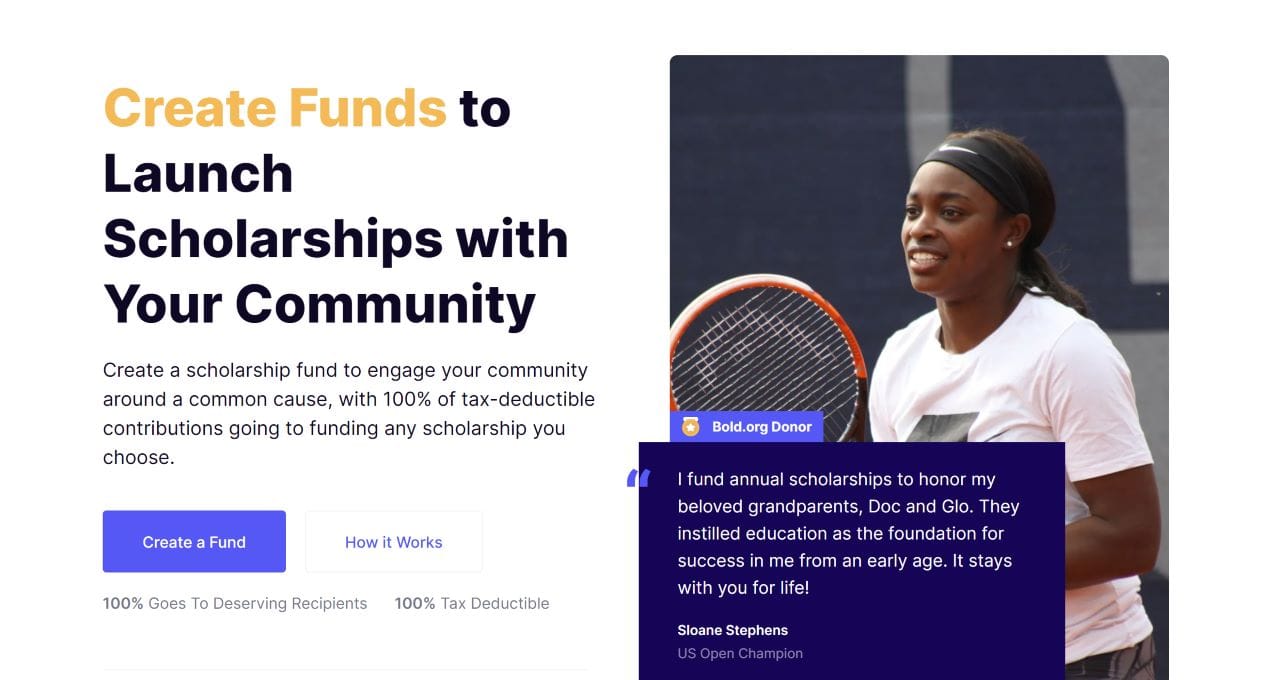

Creating Scholarship Funds

Creating a scholarship fund can be one of the first steps in promoting student debt relief. A scholarship fund is a charitable grant that helps students with necessary educational expenses, like tuition, textbooks, and other educational-related fees. Scholarship funds can be awarded to students at all grade levels without worrying about repaying them through student loan payments.

Scholarship funds are also tax-deductible. However, to be eligible for a tax exemption, the IRS requires that scholarships be awarded on a nondiscriminatory and objective basis. To ensure your scholarship is tax-deductible, please make sure to review all IRS guidelines.

Creating Scholarships

Creating scholarships with Bold.org will allow donors to establish their own scholarship(s) and raise funds for them. Once a donor profile has been created and verified as a donor, a proposal for a scholarship or grant can be submitted. Our philanthropy team at Bold.org will then reach out to the donor to schedule a call to gather more details about the scholarship creation process through our platform.

Once the proposal is reviewed and finalized, donors can begin funding their scholarships! Within just an hour of going live on Bold.org, students will be able to find the scholarship through the scholarship search feature and begin applying.

To become a donor, apply here.

Donor-Advised Funds for Scholarships

When referring to scholarships, donor-advised funds (DAFs) are philanthropic vehicles managed by a community foundation or financial institution that enable individuals to support their chosen charities, including scholarships.

DAFs are another solution for donors who want to reduce debt for student loan borrowers and invest in education. Contributing to a DAF provides donors with benefits like immediate tax deductions and allows distribution control towards funds of their choice, like scholarships. DAFs offer remarkable flexibility, enabling donors to support multiple scholarship funds through a single contribution.

For more information on donor-advised funds and their benefits, check out the Donor Blog category!

Frequently Asked Questions About Scholarships as the Solution to Student Debt

How much student loan debt is there in the United States?

Given the total student loan debt in the United States has surpassed $1.7 trillion, it makes student loan debt the second-highest consumer debt category in the country after home mortgages. The amount of student loan debt continues to rise, impacting millions of borrowers and contributing to the broader conversation around higher education affordability and financial stability.

Can scholarships help with the student loan debt crisis?

Scholarships can help reduce the student loan debt crisis by providing financial assistance to students. By awarding scholarships to students based on merit, financial need, or other factors like field of study, students can reduce their dependency on student loans for their education.

As a result, they can help lower the overall amount of student loan debt incurred by students. Scholarships can also make higher education more accessible to students from diverse backgrounds who may otherwise struggle to afford the rising tuition costs. While scholarships alone may not fully solve the student debt crisis, they can certainly help steady its impact on accessibility and make education more affordable for students.

How can donors help students alleviate the burden of student loan debt?

Donors play a crucial role in helping students alleviate the burden of student loan debt by providing financial assistance through scholarships, promoting financial literacy in their communities, and supporting initiatives that address the root causes of the crisis like taking out too much federal student loans and lack of financial resources outside of student borrowing.

Help students secure their financial future by helping them fund their education. Head over to Bold.org to learn more.