A Guide to Using Donor-Advised Funds for Scholarships

Giving for education is consistently one of the top philanthropic categories in the United States. Many donors see access to education as one of the most valuable gifts they can give. With the price of tuition increasing each year, obtaining a quality education remains difficult for many students without resorting to student loans. However, donor-advised funds (DAFs) have made providing more funding for education through scholarships significantly easier for donors, benefiting deserving students across the country.

This guide will explore the benefits, structures, and considerations of using donor-advised funds to support education. Whether you're looking to support a specific school or help students pursue education at an institution of their choice, DAFs can offer a flexible and tax-efficient way to achieve your philanthropic goals. Join us as we delve into the various aspects of using donor-advised funds to create impactful scholarships.

Are you interested in organizing a scholarship? Visit Bold.org to learn how to get started and help students achieve a higher education.

Leveraging Donor-Advised Funds (DAFs) for Scholarships

Establishing a DAF to organize scholarships allows your charitable giving dollars to benefit students and expand educational access. With a donor-advised fund (DAF), you can structure your gifts to maximize impact. Here's how DAF donors can be used to support scholarships:

School or Institution-Specific Scholarships

For donors who want their scholarship to help students going to a particular school, there are two primary approaches:

General Support: Donors motivated by positive educational experiences often set up funds at their alma mater or other meaningful schools. By working with the school's development staff, you can establish a general support scholarship to offer financial aid for low-income students. Depending on the donation size, the grant may be expended annually on an existing scholarship program or contributed to an endowment fund managed by the school. In this structure, donors are rarely involved in the selection process.

Restricted Support: A scholarship fund can also support students from traditionally marginalized backgrounds, those with merit in specific fields, or particular demographics. Donors work with development staff to set the fund and determine applicant criteria. While donors and their family members can serve on the selection committee, they cannot constitute a deciding vote or earmark funds for specific individuals.

Supporting Students at Their Chosen Schools

For donors who want their scholarship grants to help students attend a school of their choice, there are two primary approaches:

Existing Scholarship Funds: Donors can support deserving students, allowing recipients to use scholarship funds at any school. Grants can be made to existing scholarship programs at qualified nonprofits or private foundations, such as community foundations. These organizations typically have stated criteria for eligible populations, and donors can collaborate with nonprofit staff to facilitate the grant. Donors may serve on the selection committee but cannot have a sole or majority vote.

New Scholarship Funds: Donors who want to design their scholarships from scratch can work with public charities like Bold.org, the organization that powers the Bold Foundation. Donors collaborate with organization staff to define goals, communication plans, and criteria. Gifts are often committed annually to provide regular scholarship renewal. Donors and their family members can participate in determining the scholarship recipient.

Considerations for Establishing a Scholarship Using a DAF

To comply with federal guidelines, DAF donors must recommend grants to qualified charitable organizations that operate the scholarship award. Donors cannot earmark scholarships for specific individuals, and recipient selection must be made by a committee or designee of the organization managing the scholarship fund.

What DAF Donors Can and Cannot Do

DAF Donors CAN:

- Contribute to Existing Scholarship Funds: Donors can support scholarship funds managed by educational institutions, universities, and nonprofit organizations dedicated to education.

- Fund Scholarships for Specific Schools: Donations can be directed to scholarship funds that benefit students attending a particular school.

- Participate in Selection Committees: Donors can join review committees to help select scholarship recipients, ensuring their contributions align with their philanthropic goals.

- Create New Scholarship Funds: Donors can establish new scholarship funds with defined criteria, such as aiding low-income students or those pursuing specific fields like nursing.

DAF Donors CAN NOT:

- Directly Award Scholarships to Individuals: Donors are not permitted to give scholarships directly to individuals or designate funds for a specific person.

- Personally Select Recipients: Donors cannot have the sole authority to choose scholarship recipients.

- Control Review Committee Decisions: Donors and their family members cannot make up the majority of the review committee that decides scholarship recipients.

- Set Overly Narrow Criteria: Criteria for scholarship eligibility must be broad enough to apply to a charitable class of individuals, not just a select few.

Types of Scholarship Programs for DAFs

As access to higher education becomes increasingly difficult for students to obtain, donor-advised funds have become an easy way to provide scholarships and financial aid to those in need. Donors also get a say in which organizations, existing scholarship programs, private foundations, and community foundations their initial contribution will be applied to.

Bold.org offers various eligibility criteria for funding scholarships that donors can connect with and contribute to. Donors must choose scholarship programs that align with their goals, values, interests, and personal mission. For example, if you're an avid sports fanatic, your tax-deductible donation would probably be best to support scholarships for athletes.

Let's go over the types of scholarships a DAF can facilitate:

- Merit-Based Scholarships: These scholarships are for students who have excellent academic standing. They are often awarded based on a combination of high grades, test scores, and extracurricular involvement. Merit-based scholarships can help students focus on their studies without the financial burden of tuition costs.

- Arts Scholarships: These scholarships are designed for students pursuing education in the arts, including visual arts, music, creative writing, journalism, theatre, and dance. Arts scholarships can support students in honing their creative talents and pursuing careers in various artistic fields.

- Athletic Scholarships: These scholarships are aimed at student-athletes who excel in sports such as basketball, soccer, hockey, cheerleading, baseball, and more. Athletic scholarships can help students balance their academic and athletic commitments, providing financial support for their education and training.

- STEM Scholarships: STEM scholarships provide financial assistance to students interested in science, technology, engineering, and mathematics. They are crucial for encouraging students to enter high-demand, high-paying careers in technology and innovation.

- Medical Scholarships: These scholarships support students pursuing careers in healthcare, including nurses, doctors, paramedics, physical therapists, and other medical professionals. Medical scholarships help alleviate the financial burden of medical education and training, ensuring that more students can enter the healthcare workforce.

- Specific Fields of Study Scholarships: These scholarships are targeted toward students in particular fields of study based on their enrolled major. For example, scholarships may be available for students majoring in business, education, environmental science, or social work. By supporting specific fields, donors can help cultivate expertise in areas they are passionate about.

- Scholarships by Demographics: Scholarships based on demographics provide financial support to students based on income, location, race, gender, and more. These scholarships promote diversity and inclusion, helping students from underrepresented backgrounds access higher education.

- Scholarships by State: These scholarships are designed for students in specified states, cities, or regions. Donors can support local students and strengthen educational opportunities within their communities by focusing on geographic areas.

- Memorial Scholarships: Memorial scholarships are established in memory of someone, whether it be friends, family members, pets, colleagues, or other significant individuals. These scholarships honor the legacy of the deceased and have a lasting impact on students' lives.

- And more: Donors on Bold.org can select from a combination of the criteria above for eligibility for their scholarships.

Additional Considerations for DAF Scholarships

While establishing scholarships through a DAF provides numerous benefits and opportunities for impact, donors should consider several additional factors to ensure the effectiveness and sustainability of their philanthropic efforts.

- Sustainability and Long-Term Impact: One critical consideration for donors is the sustainability and long-term impact of their scholarships. Establishing endowment funds or contributing to existing endowments can ensure that scholarships continue to be awarded perpetually. Endowments generate investment income, which can be used to fund scholarships annually, providing a lasting legacy of support for education.

- Community Involvement: Engaging with the community and understanding its needs can enhance the relevance and impact of scholarships. Donors can work with local organizations, schools, and community leaders to identify areas where scholarships can make the most significant difference. Community involvement also helps build trust and ensure the scholarships align with the community's priorities.

- Monitoring and Evaluation: To maximize the impact of scholarships, donors should establish mechanisms for monitoring and evaluating the success of their scholarship programs. This can include tracking the academic progress and achievements of scholarship recipients, gathering feedback from beneficiaries, and assessing the overall effectiveness of the scholarship criteria and selection process. Regular evaluation helps in making necessary adjustments and improvements to the scholarship program.

- Collaboration with Other Donors and Organizations: Collaboration with other donors and organizations can amplify the impact of scholarships. Donors can create more substantial and far-reaching scholarship programs by pooling resources and expertise. Collaborative efforts can also lead to sharing best practices, innovative ideas, and solutions to common challenges in scholarship administration.

- Legal and Regulatory Compliance: Ensuring compliance with legal and regulatory requirements is crucial for successfully administrating scholarships through DAFs. Donors should stay informed about IRS regulations and guidelines related to scholarship grants from DAFs. Working with experienced legal and financial advisors can help navigate the complexities of compliance and avoid potential pitfalls.

Frequently Asked Questions About Using DAFs for Scholarships

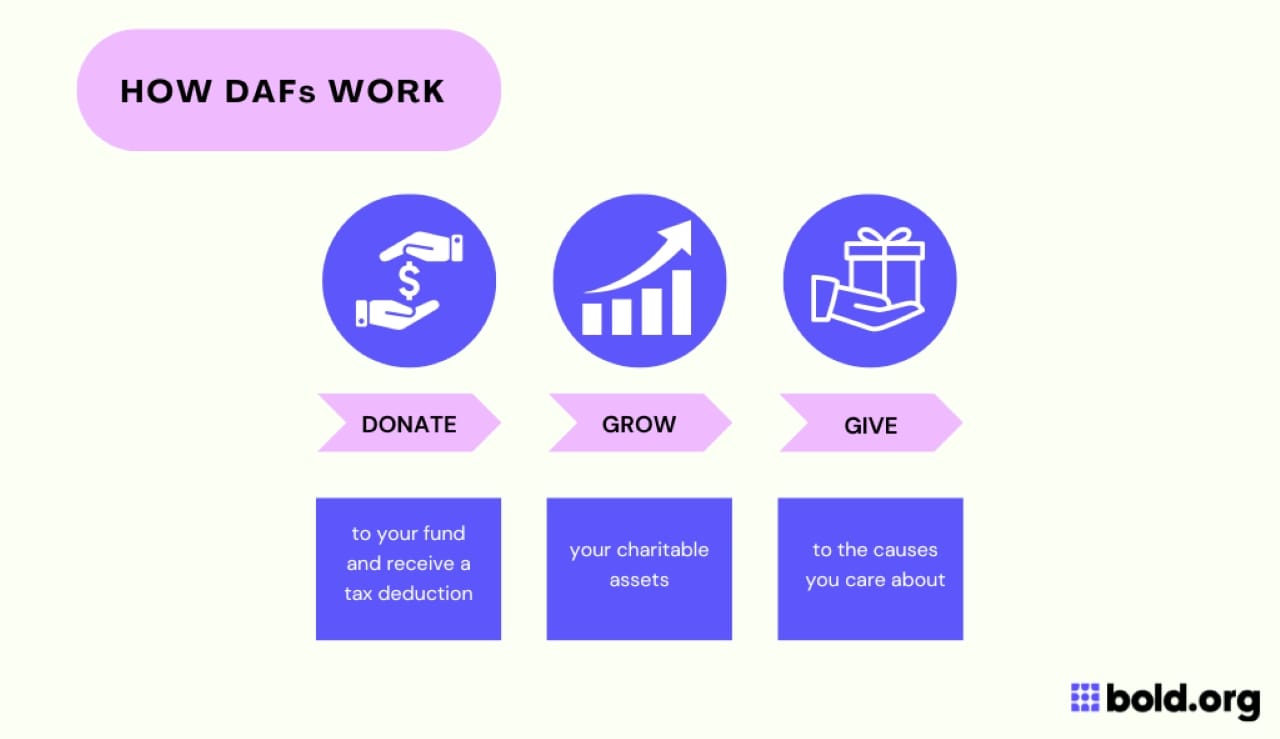

How does a Donor-Advised Fund work?

A donor-advised fund (DAF) is a charitable giving account that allows donors to contribute to, receive an immediate tax deduction, and recommend grants to qualified charitable organizations over time. The sponsoring financial institution manages the contributions and administration of the fund, while the donor focuses on reaching their philanthropic goals.

Learn more: What Is a Donor-Advised Fund?

What are the Benefits of a Donor-Advised Fund?

Donor-advised funds offer several benefits for donors. Here are some key advantages:

- Tax Efficiency: Donors receive an immediate tax benefit when contributing to a DAF. This deduction can be taken in the year of the contribution, providing potential tax benefits. Additionally, the funds in a DAF can grow tax-free, increasing the amount available for future grants.

- Flexibility: DAFs allow donors to recommend grants to various nonprofits over time. This will enable donors to support multiple scholarships or adjust their giving strategy as their philanthropic goals evolve.

Learn more: Exploring the Benefits of Donor-Advised Funds.

Can Donor-Advised Funds be used for sponsorships?

Yes, you can use donor-advised funds (DAFs) to support scholarships. Still, the funds have to go through a qualified public charity equipped to handle scholarship programs, and everything must comply with IRS regulations. Since charitable grants from DAFs cannot be made to individuals or directly to students, you'll need to team up with a qualified public charity like Bold.org to manage the scholarship funds properly.

Bold.org serves as a platform where donors can work closely with The Bold Foundation Donor team to define the goals, criteria, and selection processes for each scholarship recipient. This partnership gives donors a hands-on approach to philanthropy while adhering to legal guidelines.

How do I get started with Bold.org?

By using a DAF and partnering with Bold.org, donors can recommend grants to expand access to education through scholarship funds. Visit Bold.org to see how donors use their DAFs to support scholarships and other charitable causes or contact our team at donors@bold.org.