Can you use scholarship money for anything?

We all love the concept of free money. Find out if scholarships can be really be used for anything and tips for negotiating and applying to one!

Free money. Who wouldn't like a few thousand dollars just floating into their bank account? For many, free money seems like an impossible concept, but for others, they might consider scholarship money as "free." You aren't providing a good or service, and a few weeks later, you've got a check in your mailbox. The ideal financial solution, isn't it? In fact, I'm sure you may be wondering: can you use scholarship money for anything?

In this article, I'll be discussing the limitations of scholarship winnings and what exactly you can spend it on. I'll be drawing upon my experience applying to dozens of scholarships for college, and I'll slip in a few key tips on how to secure one! While scholarship money isn't exactly free money, it does come pretty close, so without further ado, let's get into how you can start winning and spending your scholarship money!

Attending college is a dream that is financially out of reach for many. At Bold.org, we're committed to improving access to education for everyone. By creating a free applicant profile, you can gain access to thousands of exclusive scholarships to fund your educational dreams!

Get Matched to Thousands of Scholarships

Create your Bold.org profile to access thousands of exclusive scholarships, available only on Bold.org.

Create Free Profile

What Is a Scholarship?

Scholarships are a form of aid that helps students pay for college tuition and other education-related expenses. It doesn't have to be paid back, unlike other forms of financial aid like loans, and most scholarships aren't taxable. This makes scholarships the most ideal form of paying for education. No interest, no taxes, and no strings attached!

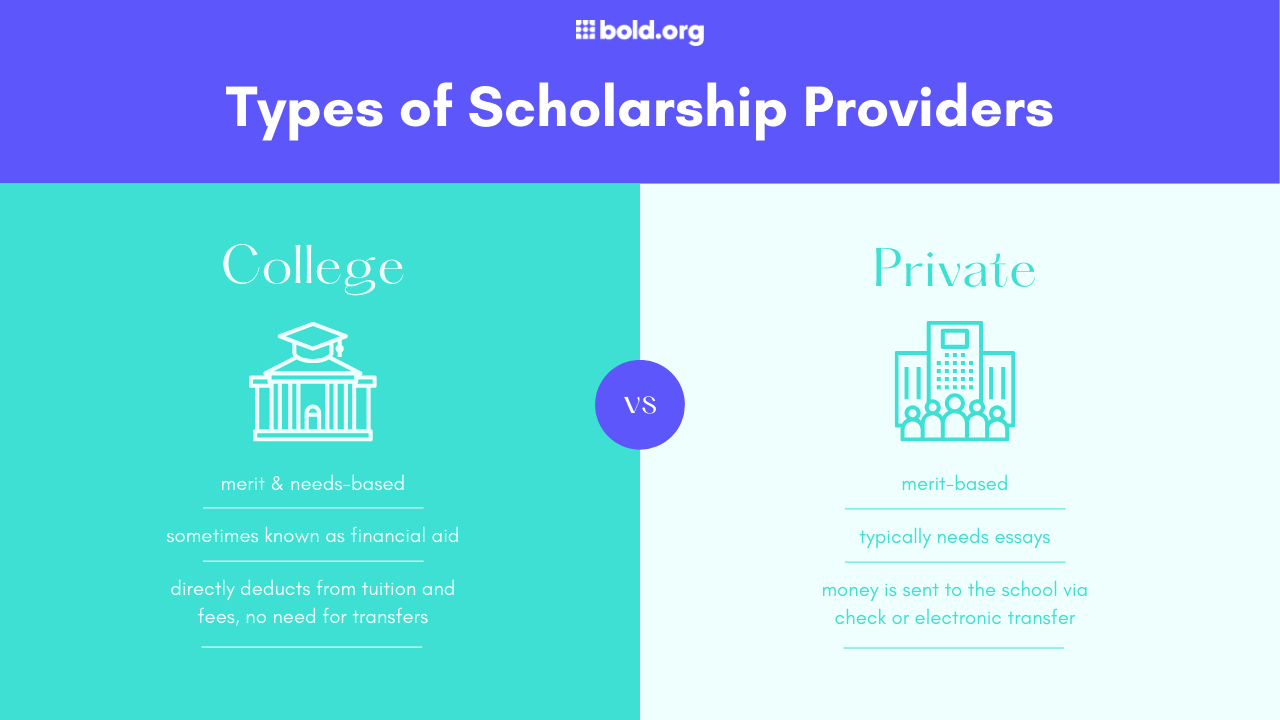

Scholarship funds usually come from two entities:

- Educational Institution: There are two types of scholarships your college may offer.

- Merit-based scholarships are awarded according to your achievements and their own criteria. These merit-based scholarships can range from a few hundred dollars to a full ride.

- Need-based scholarships (aka financial aid) are awarded based on your family income and demonstrated need on the FAFSA. These types of scholarships will directly lower the tuition and fees you must pay.

- Private Providers: Many scholarships from private donors or companies have their own application process, often requiring essays and specific eligibility criteria based on the students they aim to support. Typically, funds are sent to your university via check or electronic transfer, which then deducts the amount from your tuition and fees.

Want some examples of private scholarships? Browse thousands of exclusive scholarships on Bold.org, which are tailored to your needs and passions!

Turning Scholarships Into Cash

Unfortunately, turning scholarship money into physical cash is not allowed. Scholarship funds are financial aid awarded for an intended purpose. That specific purpose is to pay educational expenses like college tuition, student fees, and other college costs. If it is turned into cash, the scholarship providers cannot ensure that your winnings will be used exclusively for education.

Many private scholarships, such as those found on Bold.org, are paid directly to the college the recipient is enrolled in to ensure the financial aid package is being used appropriately. Therefore, students actually have no access to the funds outside of college and can only use the money for qualified educational costs.

Exceptions

In some cases, if your scholarship exceeds tuition and expenses, the extra funds may be refunded for personal use, like living expenses. However, the scholarship committee may choose to reallocate the excess, and any refund you receive is likely taxable as income. In such cases, my university has deducted from their financial aid to make up for this excess of funds.

Additionally, some private scholarships issue checks directly in your name, allowing you to deposit the funds as you wish. While this makes personal use possible, it would be deeply unethical and disrespectful to the provider. In such cases, I’ve deposited the funds into my college account and reported the scholarship to my university.

Start learning how to manage your money with our financial literacy guide for teens!

Scholarships & Student Loans

Generally, you can use scholarships to pay off student loans. Scholarships provide students with funds for a specific purpose: to help cover education-related expenses. While the exact expenses allowed vary depending on the scholarship, student loans are often considered eligible for payment under this category.

Create Your Free Profile to Apply for Scholarships Today!Each award will have its own scholarship rules on how the money can be spent, prioritizing tuition and other educational costs first. However, if your scholarship exceeds your expenses for the enrollment period, you may have extra funds available, which can be applied toward student loans.

Another way you can help pay off student loans is with our Bold Visa® Debit Card, created especially with students in mind. Check out all its unique features and apply for one today!

Negotiating a Scholarship

Negotiating a scholarship means that you enter a discussion with the scholarship provider to increase the amount you receive from the scholarship. Whether your scholarship can be negotiated depends on which type of scholarship award you have received.

Typically, private scholarships are non-negotiable. They will have a set amount of money to be awarded, and if you win, this is the amount you will receive.

However, scholarships from your university are often negotiable, especially if it is need-based financial aid. Despite what some people believe, negotiating your scholarship amount will not lead to being expelled or rejected from a university that has already accepted you.

Having successfully negotiated for a 2x increase to my financial aid package from the university, I've compiled some tips to increase your chances during scholarship negotiation!

Tips for Negotiating Scholarships

- Don’t be afraid to ask. Your current award won't be reduced, so it never hurts to request more funds. The worst they can say is no.

- Be timely in your negotiations. Contact the appropriate people after receiving your financial aid offers but before the tuition deposit and aid disbursement deadlines.

- Review the details of your scholarship carefully. Many students miss important fine print when accepting financial aid packages.

- Tell your story. Explain why you need more scholarship funds, such as covering room and board or a change in your financial situation, like a job loss. For need-based scholarships, provide documentation of financial need.

- Approach as a request for additional assistance. Rather than framing it as a negotiation, ask how you can receive more aid to match your financial needs.

- Keep your request reasonable. Ensure your scholarship request aligns with your actual expenses.

You can also supplement your financial aid package with outside scholarships. Check out these scholarships for high school seniors!

Using Scholarship Money for Personal Use

Using scholarship money for non-education-related expenses can violate spending rules set by the scholarship committee. This may result in having to repay the full amount or return the scholarship entirely, leading to a net loss. Additionally, misuse of funds can result in legal repercussions and tax liability, as outlined in scholarship contracts.

Some scholarships allow funds to be used for select expenses like room and board, living costs, or course materials. If you're unsure about the rules, contact your scholarship provider for clarification on eligible expenses.

Tips for Getting a Scholarship

Now that you know what scholarship funds can be used for, let's end on a strong note with some tips for getting a scholarship! These tips helped me to secure enough scholarships to pay for the student contribution of my financial aid package so I wouldn't have to worry about getting a job while studying.

- Start early. Begin searching for scholarships and preparing applications well before deadlines. Procrastination is not your friend.

- Research extensively. Look for scholarships that match your background, major, and interests. If you like theater, look for theater scholarships!

- Tailor each application. Customize your essays and applications to fit the specific requirements and goals of each scholarship provider. Don't just copy and paste essays (I know it can be tempting).

- Be passionate. While it's good to emphasize all your achievements, you want to really highlight the ones you care about. That passion will lift off the page and make your application truly stand out.

- Request strong letters of recommendation. Ask teachers, mentors, or employers who know you well to write personalized letters of recommendation.

- Get a proofreader. Have someone read over your application. They may catch errors or find innovative ways to present your qualifications.

- Apply for multiple scholarships. Increase your chances by applying to as many scholarships as possible, including smaller or lesser-known ones. There's no limit to how many you can apply for, so have at it!

Final Thoughts: Scholarship Money

Winning a scholarship is invaluable. Don't let it go to waste. Spend scholarship money on your education and trust me, you don't really need that new video game. Not when you'll be able to buy as much as you want once you have a college degree and a job because of it.

If you want cash for personal use, try considering these remote part-time jobs for college students to earn a little extra alongside your studies!

Frequently Asked Questions About Scholarship Money

What happens if you don't use a scholarship?

Unused scholarship funds are typically held until needed, but many providers will request a refund if the money remains unused at a certain point. Holding onto unused funds may also lead to tax liabilities, so it's best to inform the provider if you no longer plan to use the money. Returning the funds allows the scholarship to be awarded to another student in need. Always check with your scholarship source if you aren't planning to use your scholarship money for the upcoming academic year.

Can scholarships expire?

Yes, scholarships can expire. There are many reasons why a scholarship award can expire:

- Use it or lose it. You do not enroll in college, you drop out of college, or you take a break from college and do not use your scholarship money within a certain timeframe.

- You have maxed out your financial aid package. You have reached your limit on the scholarship funds.

- FAFSA and annual scholarships. You failed to reapply for the annual scholarship for the academic year.

Students are encouraged to use scholarship money as soon as possible. If you are in a "use it or lose it" scenario, recipients can try to contact their scholarship provider or financial aid office about how they can keep their scholarship awards for later use.

Are scholarships counted as income?

Most scholarships (both from the university and private providers) are not counted as income. However, if you win a scholarship from another source and you receive an amount that's greater than your total educational costs, the money may be taxed. Scholarships also become taxable if you receive the money directly and apply it to costs other than education expenses.

You might have some lingering questions about finance and education. Don't worry. We've got you covered with our comprehensive scholarship blog, home to hundreds of blogs written by students, for students!

Bold.org Visa® Debit Card is a demand deposit account provided by Pathward®, N.A., Member FDIC. Bold.org Visa Debit Card is issued by Pathward, N.A., Member FDIC, pursuant to a license from Visa U.S.A. Inc. Card can be used everywhere Visa debit cards are accepted. Visa is a registered trademark of Visa U.S.A. Inc. All other trademarks and service marks belong to their respective owners. Register your Card for FDIC insurance eligibility and other protections.